Lithium-ion cell maker A123 Systems announced today that it would supply complete battery packs to Tata Motors, the largest vehicle maker in India, to be used in hybrid systems for commercial vehicles.

The lithium-ion battery packs will first be deployed in city transit buses in the latter half of this year. Tata did not discuss further applications of the battery packs.

"A123 Systems' core lithium-ion technology has a proven track record of success in the hybrid truck and bus segment," said Timothy Leverton, the head of advanced and product engineering at Tata Motors.

"The modularity of A123's pack design enbles us to develop a uniform hybrid powertrain architecture that can be deployed across multiple vehicle platforms."

Expanding list of contracts

The contract is the latest in A123's expanding list of automotive applications. The company now sells its cells for use in several vehicle lines. Existing contracts include, among others:

- BMW ActiveHybrid 5 and ActiveHybrid 3,

- Chevrolet Spark EV,

- Daimler transit buses using a BAE Hybrid system,

- Fisker Karma,

- Roewe hybrid, plug-in hybrid, and electric vehicles (Roewe is a brand produced by Chinese maker SAIC),

- Smith Electric Vehicles Newton commercial truck, and

- extended-range electric trucks and sport utilities from startup Via Motors.

Together, those contracts add up to growing penetration for a variety of electrified vehicle uses.

None of those vehicle programs is likely to provide the high-profile publicity and high sales volume of a Nissan Leaf or Chevrolet Volt program, however.

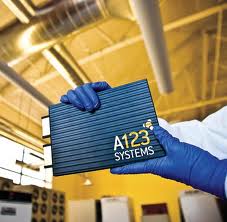

A123 Systems Prismatic Cell

A123 Systems competed in 2008 with LG Chem to provide the cells for the Volt range-extended electric car, but GM awarded the contract to the Korean company rather than to A123 Systems [NSDQ:AONE].

Fisker slowdown

The company was forced to lay off some workers at its Livonia, Michigan, battery plant last year due to significant delays in the Fisker Karma production ramp-up stemming from last-minute development and certification issues for the $106,000 range-extended electric luxury sport sedan.

The 2012 Karma was to have arrived at U.S. dealers last spring, but the first vehicles only trickled into dealerships last December--severely cutting the volume of cells Fisker needed from A123.

Fisker may be A123's marquee customer, but the luxury green-car maker is now attempting to raise more private capital after the U.S. Department of Energy froze further disbursement of funds from the low-interest loans it was granted in 2009.

At least one analyst considers A123's fate strongly tied to that of Fisker Automotive.

High-risk stock or buying opportunity?

Wunderlich Securities analyst Theodore O'Neill said in a Boston Globe interview that he doesn't think Fisker's loans will be renegotiated.

The idea of government funds supporting venture-funded startups that may fail--as did solar-panel maker Solyndra--may simply be too toxic in this election year, he said.

O'Neill suggests that if Fisker cannot get access to further DoE funds, the company is at risk of collapse--with consequent risks to A123 as well.

On the other hand, as AutoblogGreen notes, at least some investors consider A123 stock to be a buying opportunity.

The Seeking Alpha website, for one, carried an article last month predicting a 700-percent upside in A123's share price.

+++++++++++