![2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney] 2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]](https://images.hgmsites.net/lrg/2014-bmw-i3-rex-fast-charging-at-chargepoint-site-june-2016-photo-tom-moloughney_100557788_l.jpg)

2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]

The Volkswagen diesel emission scandal erupted last September, when the EPA formally issued a Notice of Violation to one of the world's three largest automakers for willfully violating U.S. emission laws for seven years.

Since then, much speculation has appeared over what forms of punishment VW would face and how much it would have to pay.

We now have a number, and it’s even higher than many expected.

DON'T MISS: VW diesel settlement details: buybacks, payments, modifications, fines, more

The Volkswagen Group has agreed to pay up to $14.7 billion for intentionally deceiving the public and selling vehicles that emit up to 40 times the legal limit of certain pollutants.

The penalty has three parts:

- Buybacks and financial settlements to owners of 466,000 affected vehicles: $10.0 billion

- Compensation for the illegal cars' environmental impact: $2.7 billion

- Fund new infrastructure and access for zero-emission vehicles: $2.0 billion

2012 Volkswagen Passat TDI Six-Month Road Test

When the story first broke last year, I couldn’t help but wonder how a portion of the fines could be used to help offset the damage these heavily-polluting vehicles had done to our air quality.

If at least some portion of the ultimate settlement wasn’t directly used to encourage the transition to zero-emission vehicles, I feared we would have missed a golden opportunity.

Fortunately, that wasn’t the case.

ALSO SEE: How VW Can Atone For Diesel Deception: Electric-Car Advocate's Thoughts (Sep 2015)

As part of the settlement, the VW Group will provide $2 billion over 10 years to fund infrastructure for zero-emission vehicles (both electric-vehicle charging and hydrogen fueling stations).

It will also fund consumer-awareness campaigns, and invest in car-sharing programs that will increase access to zero-emission vehicles.

The State of California will get 40 percent of these funds, or $800 million—$200 million every two and a half years—with the remaining $1.2 billion allocated to similar programs in other parts of the country.

EVgo DC fast-charging site in Fremont, California

This was exactly what I hoped would happen when I wrote an article on this site last September that suggested how Volkswagen could atone for its diesel deception.

I didn't include allocating some of the money to hydrogen fueling stations. But that part of the settlement isn't surprising, considering California’s recent stance on supporting the hydrogen fuel-cell industry.

Now that we know there will be funds for electric-vehicle infrastructure, the next questions are how the money will be used—and what bodies will oversee the implementation.

CHECK OUT: Electric-Car Charging Network Ecotality Files For Bankruptcy (Sep 2013)

It’s essential to have a cohesive plan, to install robust and well-proven equipment, and ensure that project leaders understand the needs of both users and the auto industry.

Learn from history

Simply trying to install as many charging stations in as many locations as possible, as quickly as possible, isn't sufficient—as the $100 million provided to Ecotality five years ago demonstrated.

ECOtality Blink charging station for electric & plug-in cars

The inferior hardware used in that project, as well as poor customer support, spelled doom for Ecotality. It filed for bankruptcy just four years after receiving its grant.

In my previous article, I proposed using money from the civil fine to install a comprehensive national network of high-speed DC fast chargers.

What Tesla Motors has done in a few short years to implement a nationwide (and increasingly global) Supercharger network underscores that it’s not an impossible task.

Why not start by trying to strike a deal with Tesla to install CCS and CHAdeMO fast-charging stations at existing Tesla Supercharger sites? I’d even see if Tesla is interested in bidding on the entire project, from installation to management of the sites.

![2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney] 2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]](https://images.hgmsites.net/lrg/2014-bmw-i3-rex-fast-charging-at-chargepoint-site-june-2016-photo-tom-moloughney_100557788_l.jpg)

2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]

The company has proven that it can install the hardware and manage the sites, often a significant problem for locations using the other two DC quick-charging standards (CCS and CHAdeMO).

Excellent Supercharger site ratings

Just ask any electric vehicle owner. You'll hear that in many cases, pulling up to a fast-charging site is a lot like rolling the dice.

Often the stations are located in prime parking spaces on the property, meaning they're frequently blocked by gasoline cars—making them unusable for charging.

At other times, the driver finds the station is simply dead.

![Tesla Model S at Supercharger site in Ventura, CA, with just one slot open [photo: David Noland] Tesla Model S at Supercharger site in Ventura, CA, with just one slot open [photo: David Noland]](https://images.hgmsites.net/lrg/tesla-model-s-electric-car-road-trip-upstate-new-york-to-southern-california-photo-david-noland_100500011_l.jpg)

Tesla Model S at Supercharger site in Ventura, CA, with just one slot open [photo: David Noland]

A recent user poll conducted by the PlugShare charging-site locator app gave Tesla Superchargers user experience ratings of 94 percent excellent. The DC fast-charge stations from all other networks were rated only 21.3 percent excellent.

Even worse, nearly 60 percent of the non-Tesla sites received a Poor or Very Poor rating, while less than 1 percent of respondents gave a Poor rating to Tesla Superchargers.

Tesla’s excellent record is likely due to the fact that it is the owner and operator of the sites, and its business model requires a robust nationwide charging network.

Whatever entities are chosen to oversee use of the infrastructure funds provided in the VW settlement should take a long look at Ecotality's use of its $100 million dollars, and learn from that company's many mistakes.

It would be tragic if that history were to repeat itself.

Plug-in electric cars at PSE+G facility in Newark, New Jersey

Workplace charging too

While high-speed charging infrastructure should be the main focus of the Volkswagen funds, I would also like to see some of the money allocated to workplace charging.

Next to charging at home, usually overnight, workplace charging is the second most import type infrastructure to make plug-in electric cars truly practical for buyers beyond early adopters.

A good place to start would be to expand the Department of Energy’s EV Everywhere Workplace Charging Challenge, and to include grants for employers that meet certain criteria.

Still, the vast majority of VW $2 billion should—in my view—be allocated to installing DC fast chargers along U.S. Interstates and other major highways.

![2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney] 2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]](https://images.hgmsites.net/lrg/2014-bmw-i3-rex-fast-charging-at-chargepoint-site-june-2016-photo-tom-moloughney_100557788_l.jpg)

2014 BMW i3 REx fast-charging at Chargepoint site, June 2016 [photo: Tom Moloughney]

These stations should be capable of delivering a minimum of 100 kilowatts on launch, with provisions in the electrical supply to enable higher rates later on.

Both the CCS and CHAdeMO supporting associations have recently announced they are working to offer at least 150 kw charging in the near future, and possibly up to 300 kW.

Make sure it's future-proofed

Even if it requires waiting another year or two for the stations to come online, the groups that allocate the VW funds must ensure that the higher speed stations are available, rather than rushing to install yesterday’s technology (capped at 50 kw).

Longer-range vehicles with much higher-capacity batteries are coming (the Chevrolet Bolt EV, next-generation Nissan Leaf, and Tesla Model 3 are only the start). They will need higher charging rates to recharge their batteries in a reasonable time.

2017 Chevrolet Bolt EV pre-production vehicles at Orion Township Assembly Plant, March 2016

The current 50-kw rate just isn’t fast enough for long-distance driving in an electric vehicle with a battery of 60 kilowatt-hours or more. Taking an hour and a half to add 175 miles of range won’t be acceptable for many potential buyers.

(Tesla Motors, of course, is already there, with rates of 125 kw at Supercharger sites to Model S and Model X drivers.)

But above the charging speed, it's paramount to understand the purpose of devoting most of Volkswagen's $2 billion to installing DC quick-charging stations.

National master plan needed

The settlement should provide enough cash to develop and execute a master plan for a true national charging network for plug-in electric cars—which would greatly expedite the proliferation of electric cars into the broader market.

Instead of the small, ad hoc installations we’ve seen so far, we must develop a master plan for national electric-car charging—just like the one Tesla has been building for four years.

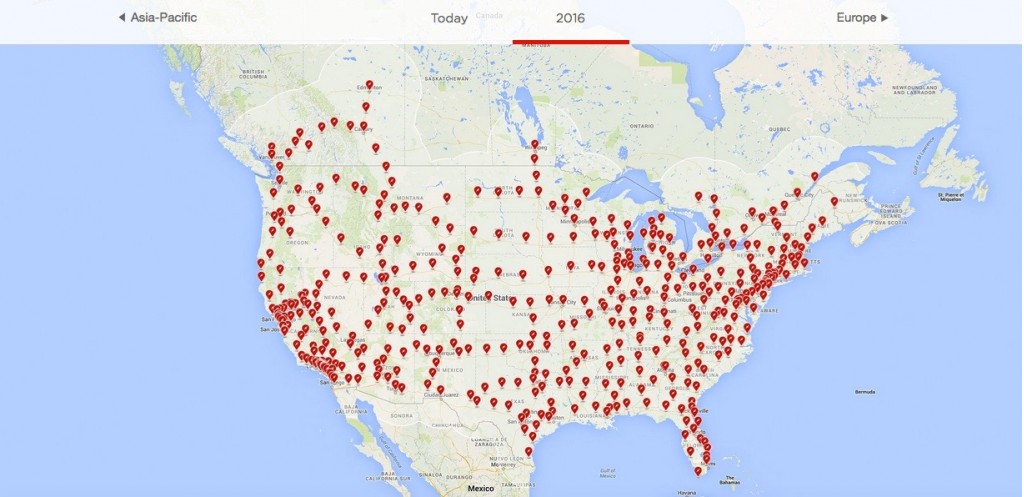

Tesla Motors Supercharger network in the U.S. - projected 2016 installations

Even if it can’t be entirely completed with the funds from the VW penalty, we should at least get it started. I’m all for asking Tesla if the company would like to be involved in the implementation.

After all, who’s better at installing charging infrastructure than Tesla? They have the locations, they have the contractors, they have the management in place.

But would Tesla really want to take this on, even if it proved profitable, with everything else it has to do?

CEO Elon Musk has said many times that his mission is to bring electric mobility to the world, and that he won’t stop until all cars are electric.

Agreeing to share Supercharger locations with stations that competing cars could use would surely advance that goal.

_______________________________________