To say that the auto industry has been startled by the volume of deposits on the Tesla Model 3 would be an understatement.

The number of potential buyers worldwide who have sent Tesla Motors $1,000 to reserve a place in line to buy the car is now approaching 400,000, said longtime executive Diarmuid O'Connell.

And at least one financial commentator has asked whether the total could be as high as 1 million by the time the car enters production.

WATCH THIS: Tesla Model 3: video of first ride in prototype $35k electric car

The number of deposits startled CEO Elon Musk, as his flurry of tweets after the March 30 unveiling seemed to indicate.

And the massive deposit queue imposes some new and additional challenges on Tesla, on top of several huge hurdles it already had to overcome between now and the start of Model 3 production.

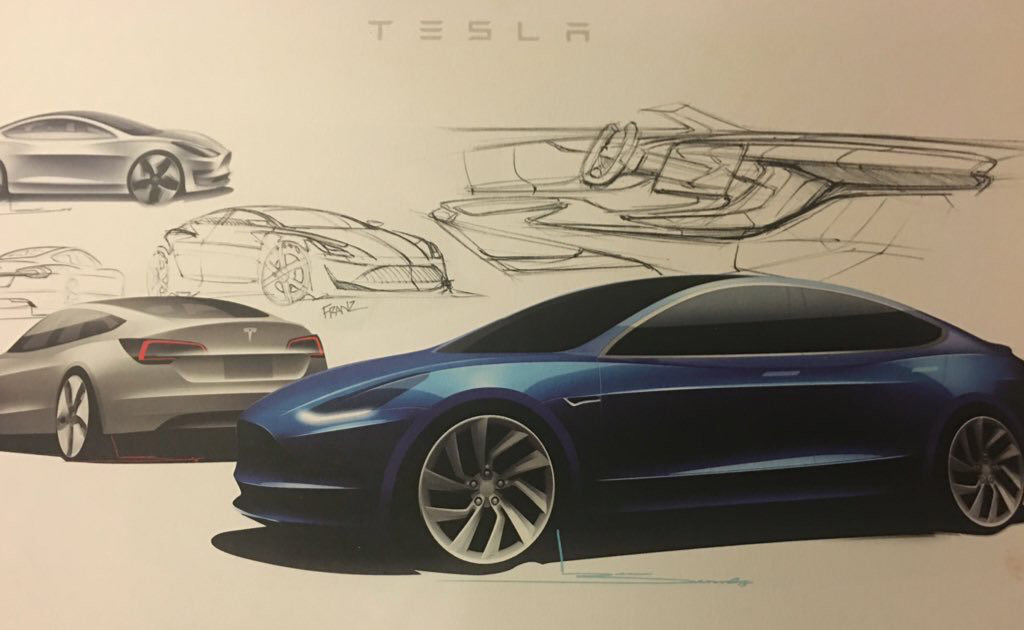

Tesla Model 3 design prototype - reveal event - March 2016

First, the new hurdles that have arisen since the Model 3 unveiling.

(1) Higher volume requires more cash

Elon Musk tweeted the day after the launch event that the company was "definitely going to have to rethink [its] production planning" for the Model 3.

Definitely going to need to rethink production planning...

— Elon Musk (@elonmusk) April 1, 2016

It remains to be seen whether that means ramping up higher volume production faster, or adding more capacity over time than planned, to give Tesla a higher total capacity faster than that 500,000-by-2020 volume Musk has previously projected.

But either plan will likely require larger capital expenditures sooner than Tesla had projected just last month, before the Model 3 hoopla.

Certainly $400 million in deposits is nothing to sneeze at, and Tesla already has several empty factory buildings at its Fremont, California, assembly plant.

DON'T MISS: Tesla Model 3 reservations rise to 325,000 after one week

But its projections about the ramp of Model 3 production and the associated capital costs—and how they're spread over the coming years—almost surely require more cash quicker than previously expected.

In other words, a Tesla capital raise is more likely now than it was when the topic was discussed after the 2015 financial results were released in February.

(2) Will hundreds of thousands of reservation-holders wait years for their cars?

Few electric-car advocates and financial analysts expect that Tesla will begin its first production of the Model 3 late next year, as it has committed to do.

Tesla Model 3 Driving on a Public Road

The company could surprise them all, but thus far, it hasn't come within even a year of meeting the originally-announced production date for any vehicle it's sold.

History also shows that, quite sensibly, Tesla ramps up production gradually to address feedback from the earliest buyers and keep early build quality as high as possible.

That means of the 400,000 current depositors, at least 350,000 of them likely have no chance of getting a Model 3 until 2019, more probably 2020 or later.

How long they will be willing to wait is a huge open question.

Tesla Model 3

(3) The competition noticed

Certainly Tesla's following and the allure of the Model 3 has shocked the industry.

And thus far, the company seems to have largely overcome startup quality hurdles among its owners.

But buyers who want a 200-mile electric car will have several choices from more established carmakers by 2019.

CHECK OUT: Is Chevy Bolt EV's Main Mission To Marginalize Tesla Electric Cars?

Those cars clearly won't have the Tesla cachet, but GM, Nissan, and BMW will likely all have a track record of producing reliable battery-electric vehicles by then.

How many Model 3 depositors want to buy a 200-mile electric car for $35,000, and how many only want a Tesla?

Will the former group be willing to postpone their Model 3 purchase, and start with a 2017 Chevrolet Bolt EV, a 2018 Nissan Leaf, or future 200-mile electric cars from Volkswagen, Hyundai-Kia, or other makers?

Tesla Model 3 design prototype - reveal event - March 2016

Today, no one knows.

But you can be very sure that the legacy automakers are all looking at that question—and asking what it would take to offer their competitors to the Model 3 or Bolt EV sooner than planned.

And the lithium-ion cell makers they will buy from are doing exactly the same.

Tesla Model 3 design prototype - reveal event - March 2016

Those three new factors add to four ongoing challenges that Tesla and its advocates have long known it faced:

(4) Increasing total volume by 10 times isn't trivial

The Tesla "secret master plan" published years ago envisioned that the third-generation car would be the high-volume entry to bring electric cars to mass buyers.

And thus far, the company is tracking against its master plan.

So it's not like Tesla didn't know it would face the hurdles of scaling up volume from 50,000 to a projected 500,00 cars a year.

ALSO SEE: Tesla Model 3 depositors vs Chevy Bolt EV: sea change or double standard?

But as any plant manager or automotive production engineer can tell you, the challenges of getting any new production line up and running are many and costly, in both time and money.

More challenging yet is that a $35,000 car has far less leeway to spend a few dollars to fix a problem than does one that starts at $70,000.

Luxury buyers are relatively less sensitive to the addition of a few extra dollars, but that's not at all the case with mass-market buyers

Tesla Motors production line for Tesla Model S, Fremont, California

Cause for optimism, however, can be found in Musk's frequent admissions that the Model X was overly complex, and that the company might not design it the same way if it had the car to do over.

That's a reference to the unique, complex, costly, and very hard-to-manufacture falcon doors. They make the Model X distinctive, but they clearly delayed it by months if not years.

If Tesla really has "learned its lesson" and will keep the Model 3 simple, it now has eight years of manufacturing wisdom under its belt.

Mark the outcome of this one as yet-to-be-determined.

Tesla Model X Introduction - Fremont, CA, September 2015

(5) Model 3 pricing must be very carefully calibrated

Musk has said the company expects to be building 500,000 cars a year by 2020, almost exactly 10 times in 2015 deliveries of 50,557 vehicles.

But with Model S prices now starting at $72,700 including delivery, its Model S and Model X vehicles are clearly luxury cars available to only a tiny portion of the global market.

If a reasonably-equipped Model 3 can indeed be purchased for $35,000, that puts it just slightly above the average U.S. new-vehicle transaction price of about $33,000.

Model S sales seem to indicate, however, that today's Tesla buyers have a heavy hand on the options list.

2016 Tesla Model S P90D and Boeing 737 drag race

Musk has said the mix of Model S options was higher than the company projected, leading to higher average sales prices.

But if things like Supercharger DC fast-charging capability, Autopilot software, that sexy glass roof, and other selling points are all extra-cost options, a more desirable Model 3 could arrive with a price of more like $45,000 or even $50,000.

If depositors who expect that the Model 3 they saw introduced two weeks ago will cost $35,000 find that the actual $35,000 version has less equipment, lower performance, or other drawbacks, many could become disillusioned.

Tesla Model 3 design prototype - reveal event - March 2016

(6) Pricing affects volume, drastically

As Salim Morsy of Bloomberg New Energy Finance has pointed out, there's only a single sedan priced above $35,000 that sells even 100,000 cars per year in the U.S.

That's the BMW 3-Series, which has 30 years of reputation behind it, not to mention a huge marketing budget.

But if Tesla builds 500,000 cars a year in 2020, let's say half of those are intended for the U.S.

Even if the Model S and Model X each sell 50,000 a year in the U.S., that means the Model 3 has to sell 150,000 in the U.S. within two or three years after its launch.

For Tesla to outsell BMW's most popular car by 50 percent that soon after launch would require essentially every star in the universe to align correctly.

2017 BMW 330e i Performance

(7) Few if any Model 3s will benefit from the Federal electric-car tax credit

By 2020, Tesla will have reached its cap of 200,000 sales under the current Federal incentive for electric-car purchases.

That means that the bulk of Model 3s sold will remain $35,000-plus cars, without a lower effective California price after incentives that is $10,000 less.

There are numerous $25,000 sedans that sell 250,000 units or more a year in the U.S. But the Model 3 won't be in that group.

That makes it vitally important that Tesla hit its price target, and that Model 3 prices fall over time, rather than rising as Roadster, Model S, and Model X prices have.

_______________________________________