2013 Toyota Prius liftback

Many who follow the progress of plug-in electric cars wonder why Toyota, despite its leadership in hybrids, lags other carmakers in its electric vehicles.

The business principle of The Innovator's Dilemma suggests that the company has been slow to embrace electric cars not despite its hybrid leadership, but because of it.

And the biological phenomenon known as Kleiber's Law may suggest that Toyota has no cause for concern… just yet.

Hybrid hero

Toyota began developing its hybrid technology in the mid-1990's, and launched the Prius in December 1997, beating the Honda Insight to market by two years. (Honda did beat Toyota to North America, as the Prius was sold only in Japan for its first three years.)

Since then, Toyota has leveraged first-mover advantage into market leadership and dominance. It offers the broadest hybrid-vehicle selection and captures the greatest sales volume: the Prius family recently surpassed three million sales, and Toyota's 23 hybrid models have now sold five and a half million vehicles between them.

Doubling down on its leadership, the company has announced plans to offer an additional 18 new hybrids in the next three years.

In our current era of expensive, $100-per-barrel oil (about $2.40 per gallon or 60 cents per liter, prior to taxes) it's worth revisiting the world into which the Prius debuted.

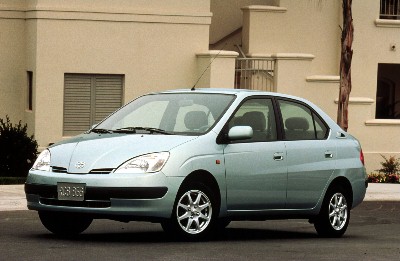

2000 Toyota Prius

By and large, oil prices had held steady between $15 and $25 per barrel for more than a decade, reaching a low of $10 a barrel in late 1998.

Fuel efficiency was not on the radar in North America, though it was a consideration in Europe and Japan, where gasoline was more heavily taxed--perhaps reflecting these regions' nervousness about their dependence on oil imports.

Ironically, the Prius' own technology was partly based on expired hybrid engine patents filed by American firm TRW during the first OPEC oil shock, when oil import dependence first became an issue in North America.

The innovator's dilemma: Why Toyota's tepid on electrics

Long the hybrid leader, Toyota now languishes in third place behind Nissan and GM in cumulative plug-in vehicle sales, and may soon fall further behind Ford and Tesla in monthly figures.

According to the theory of The Innovator's Dilemma, this is to be expected.

Formulated by Harvard Business School professor Clay Christensen, the principle essentially states that the leading innovator in one technology -- call this Tech A -- tends to fall behind when The Next Big Thing -- a disruptive innovation we'll call Tech B -- comes along.

The dilemma occurs because the innovative company's resources tend to get tied up meeting the needs of its current customers. After all, they pay the bills.

This generally means the company exploits its hard-won Tech A advantages, instead of embracing Tech B, which in its early days often offers a compromised solution and lower profit margins.

2013 Toyota Prius liftback

The textbook example is disk-drive industry. In the 1970's and 1980's, industry leaders rose and fell as the disk drive they specialized in (14", then 8", then 5.25", and finally 3.5") ascended to prominence and then collapsed into oblivion.

A more recent case is Samsung eclipsing of Sony in television displays, because Sony's commitment to its vaunted Trinitron CRT technology made it slow to recognize that flat-screen LCD's were the future.

Fifteen years ago, the early Toyota (and Honda) hybrids were lower profit-margin vehicles with relatively sluggish performance. At the time, the Big Three were all focused on higher-margin sport-utility vehicles, where their expertise in truck platforms gave them an edge.

In recent years Toyota has expanded the Prius family and successfully incorporated hybrids throughout its product line--exactly the kind of behavior "Tech A" companies exhibit.

Its very dominance in hybrids likely contributed to General Motors downplaying its own full-hybrid efforts and forging ahead instead with the "Tech B" of electric vehicles.

2013 Nissan Leaf, Nashville area test drive, April 2013

In a display of possibly-ominous hubris, Toyota chairman Takeshi Uchiyamada -- known as the "father of the Prius" -- has variously dismissed electric vehicles as too costly and compromised (in range and recharging time).

Again, this conforms to the Innovator's Dilemma pattern. Uchiyamada instead is bullish on fuel cells, which in this scenario might represent a "Tech C".

Kleiber's Law

Whether they're disruptive or sustaining innovations, no one expects plug-ins or hybrids to outnumber conventional internal-combustion-engine vehicles any decade soon.

To understand this, we turn to Kleiber's Law from the world of biology. Note that's K-l-e-i-b-e-r, and has nothing to do with these guys, or her.

Kleiber's Law notes that as animals get bigger, their metabolism gets slower. To dip into technical jargon, animals' metabolic rate scales to the three-quarter power of their mass.

For example, a mouse's heart rate is about 500 beats per minute, and in captivity it might live a year. Whales come in at 20 beats per minute, and have a 12-month gestation period! The law is widely accepted, though there's the typical academic quibbling around the margins.

Kleiber's Law is worth keeping in mind when considering the automobile sector, which sells the biggest, most expensive widely-purchased household appliance in the world.

As a result:

(1) Product development cycles are long. Models often go four to five years between redesigns, to allow the company to recoup development costs, which can reach a billion dollars (as with the Volt). Twenty years' patent protection is only enough for three product generations, after which competitors can freely copy any breakthroughs. In many industries this would be too late, but in the auto sector it isn't, because…

(2) Production costs are enormous. In 2008 Toyota announced it would invest $600 million to build a manufacturing plant in Brazil, capable of producing about 70,000 vehicles… or 0.1 percent of the worldwide new car market. Even when companies have transformative products, they have difficulty putting weakened competitors out of business, given how expensive it is to expand.

2013 Chevrolet Volt, Catskill Mountains, Oct 2012

The auto market is also highly fragmented, by both consumer preference and purpose. Automakers who are behind in one category can often prosper due to strength elsewhere.

Many car-buyers also exhibit strong brand loyalty and/or national pride in their purchases, as evidenced by home-country automakers making the 56 best-selling cars in Japan and the 28 best-selling cars in Germany in 2012.

Non-lethal case of lagging

Putting all of this together, we would suggest that Toyota's slow start in electric vehicles is (counter-intuitively) due to of its leadership in hybrids.

While the company would be well-advised to redouble its efforts in this fast-growing segment, Toyota is unlikely to face difficulties in the short term from this decision, given its huge size and its strength in other market segments.

That said, battery-electric vehicles in particular are simpler and have fewer moving parts than cars with engines--let alone hybrids with both engines and electric running gear.

As batteries costs fall, some analysts suggest that consumers will catch onto one advantage of electric cars that so far isn't much discussed: They're nicer to drive than cars with engines.

If that happens, will Toyota be ready to respond?

_______________________________________________