Atlis Motors CEO Mark Hanchett drives a 3/4-ton diesel pickup. He also owns a Tesla Model 3. But he admits he likes driving the pickup more.

With the Arizona-based electric-truck company he founded, Hanchett says his goal is partly to surpass what his diesel truck can do today, but with a whole line of vehicles offering a “seamless, clean ownership experience.”

”I want to build things that make people’s lives better,” Hanchett said last month, at the close of a wide-ranging conversation with Green Car Reports.

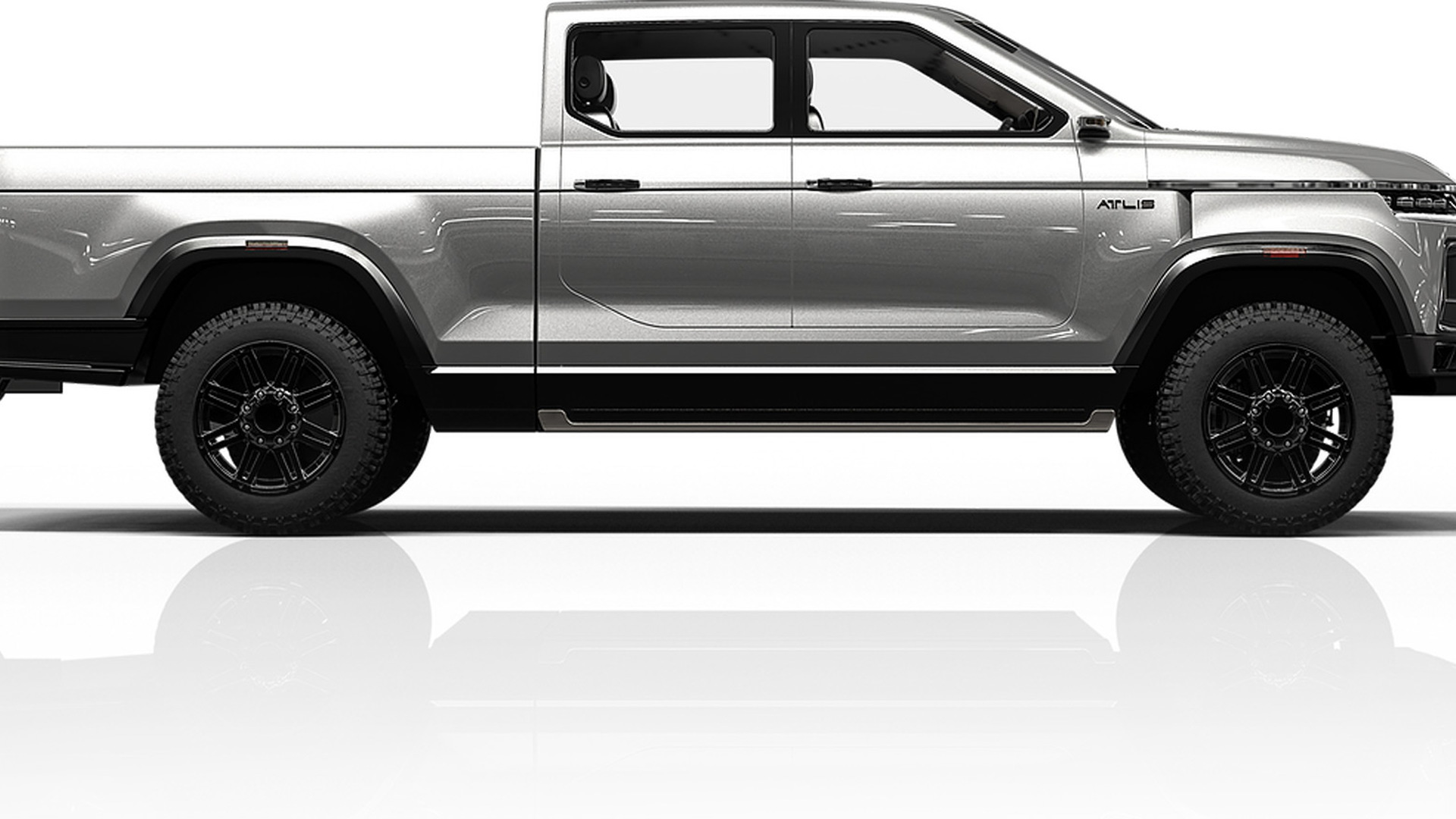

Atlis XT

The start of that will be a crowdfunded product in an untapped market, aiming to provide the same level of towing and hauling capability as that heavy-duty pickup he owns, with a fast and consistent charging experience.

It's a daunting product in and of itself, but behind that looms a big, seemingly impossible vision. Hanchett’s team is working on a truck, the XT, capable of towing 35,000 pounds or carrying a 5,000-pound payload, and offering up to 500 miles of range. It’s also aiming to conceive a 1.5-megawatt charging network that’s capable of bringing that truck from 0-100% in 15 minutes—“that’s as simple to operate as filling up your gas vehicle today or plugging in a Tesla vehicle,” explains the company’s site.

To allow all of this, it’s also seeking to develop a new battery cell format (something Tesla is just now tackling), to be placed in an unproven multi-voltage battery layout.

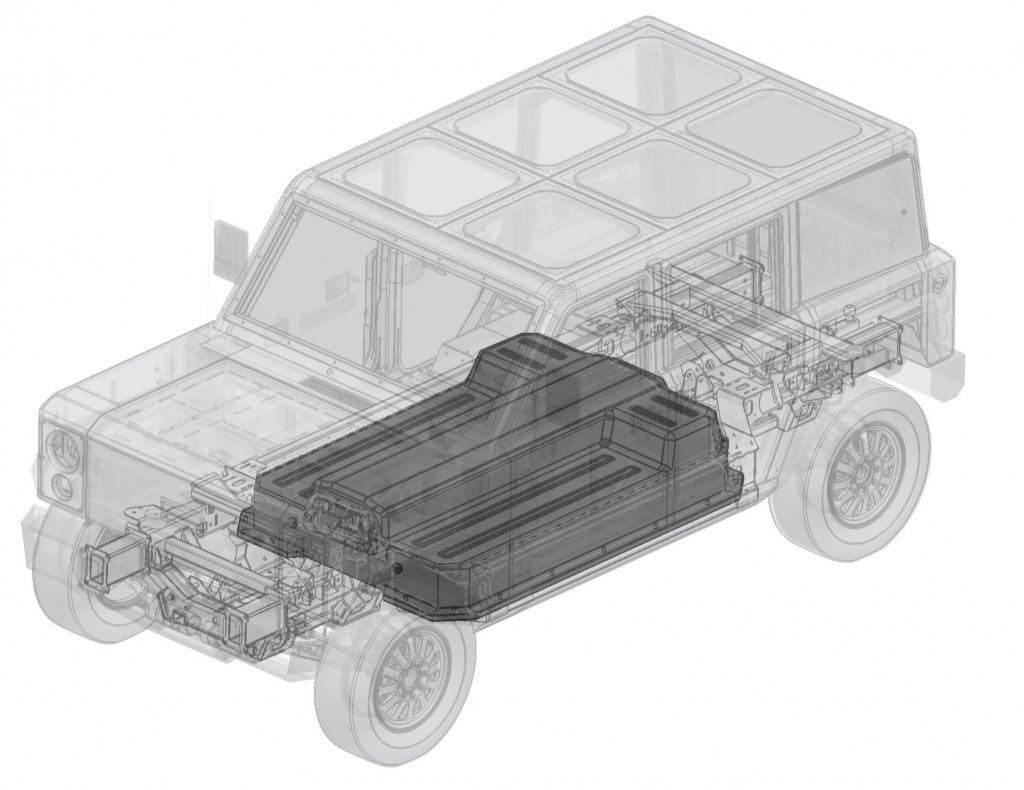

Atlis XP platform

The company’s vehicle and technology platform will host plug-and-play modules in a vastly simplified but unconventional layout that will apply to forthcoming vehicles as well as the XT.

At face value, it’s the kind of undertaking that sounds like it could bankrupt a legacy automaker. Or from the flip side, to speculators, such a grand vision in developed form could rival Tesla, Rivian, and others, provided Atlis is sitting on game-changing technology. There's no evidence of that, however.

Hanchett is like no other CEO I’ve interviewed in 20 years of tracking automotive startups. He has a detail or anecdote on the ready for each potential obstacle, and impresses as both down-to-earth and enthusiastic—as well as blithely optimistic.

Price up front, then lots of small print

As is customary in crowdfunding, a price has been given for the product before the bulk of development. An XT pickup truck will serve as the launch vehicle and flagship—starting at $45,000, with a 10,000-pound tow rating and a 125-kwh pack with an alleged 300-mile range. The top 500-mile model will cost $78,000 with the gooseneck/5th-wheel setup required for 35,000-pound towing.

Atlis hasn’t backed away from a targeted late 2021 arrival—although Hanchett has said that a “scalable product” with the $45,000 price might be nearly three years out from now. Atlis started crowdfunding in January 2018 and then targeted 100 pickups delivered to early customers, with the first pickups complete rather than “beta” efforts.

For the Atlis XT, Hanchett pointed to a focus on “vehicle upfitters and the forgotten markets that are out there for electrification.”

Atlis XP platform

Underpinning it all will be an XP technology platform, described by Atlis as “a scalable technology solution with a connected cloud, mobile, service, and charging ecosystem that will provide unprecedented workflows and customer experiences moving forward.”

Atlis doesn’t plan on contracting much out. According to Hanchett, Atlis has already built in-house the motors, gearboxes, frame, and suspension for the platform and/or the truck, as well as body control modules, vehicle dynamic systems, and braking systems. It’s also filed “a few dozen” patent applications, according to Hanchett, with some of them relating to the battery and charging technology.

A big lift on batteries

They’re also setting up pilot production lines to produce a proprietary large-format prismatic NMC cell, dimensions not yet disclosed, that could make or break the company’s plans. Atlis’ approach involves having each of its cells—rather than the module or the whole pack—submerged in thermally managed coolant, so that they each function as part of a heat exchanger.

Those cells won’t go into conventional modules, but instead into separate high-voltage battery packs that would use a new kind of battery management system to balance themselves. Through a smart switching system, the 400V packs have the capability to change their effective voltage of the entire pack to 800V or 1,600V on demand—allowing back-compatibility for 400V CCS charging.

What is described is a more advanced ability set than Volkswagen Group and Hyundai are reportedly working on for their multi-billion-dollar premium EV platforms, or what would likely be possible with GM's Ultium battery system—which uses a new kind of wireless battery management system. And barriers for going high-voltage aren't just related to the battery. As Porsche and Lucid have told me, it's a systemic design choice that demands a level of detail to everything from wiring harnesses to component spacing, that adds cost and effort.

Atlis XP modular electric car platform

Atlis fashions itself “a start-up mobility technology company,” rather than an automaker, even though Hanchett admitted that the vast majority of its attention so far has focused around the XT truck. “Our focus is really to be sort of the Apple of energy and vehicle systems, so we’ve got an energy group that’s focused on energy storage, charging infrastructure, battery technology,” he said.

“We haven't shifted, we haven't changed direction, we haven't hit a wall that says we were wrong,” insisted Hanchett, when asked about whether the goals have shifted somewhat as the project progressed. “Everything says we are on the right path, the data matches the theory that we've had for several years, all the work we did in the past.”

Testing some of the core tech

Atlis announced on Monday the signing of two memorandums of understanding with companies that will help establish a production line for cells and packs at its Arizona headquarters. South Korea–based Media Tech will supply, install, and calibrate the basis for “a limited-run prototype battery cell production line,” while Greatech, which is based in Malaysia but has a Detroit-area factory in the works, will supply the equipment for limited-production prototype packs.

The company claimed to have signed off on the design of its cells in December. If the prototype cells and packs meet expectations, Atlis said in a press release that they’ll explore “the development of high-volume lines designed to produce millions of cells and hundreds of packs per month.”

How will Hanchett and Atlis plan to do everything else leading to a launch in less than a year? Some simple reality checks are in order.

Crowdfunding the dream

SPAC-enabled IPOs for startup electric-vehicle makers seem to be all the rage: Fisker, Nikola, Lordstown, and Canoo are just a start. Yet Atlis Motors has no plans to go public in the near future, or to court big private equity investments. It’s instead in the midst of that $25 million crowdfunding campaign—launched last August and ending by July 2021—with $2 million from previous crowdfunding campaigns. As of January 29 its website showed a total of nearly $4.23 million raised.

How Atlis plans to do a lot with a little

The company says that just $25 million will get it from its current concept and design stage to having “a fully tested and validated production-ready prototype with manufacturing line equipment ready and production started.”

Less than a year from the vehicle’s late-2021 arrival, Atlis Motors has about 50 employees, and plans to be at 163 by mid-year, pulling out of the pandemic. Platform, vehicle, and batteries are due to come out of a 44,000-square-foot plant that can potentially be doubled.

Atlis XP platform

Atlis’ website also now highlights that it’s at $2 billion reservations—the theoretical revenue from sales of the finished trucks if crowdfunding investors decide to buy.

Through an arrangement that’s not unusual in crowdfunding, “Atlis Motor Vehicles has chosen to forego the requirement for a refundable deposit in favor of allowing reservation holders to become a potential investor,” it says, with the offering of either that amount (or more) off the XT or a “subscription membership.”

Atlis was conceptualized in 2014, and formed as a Delaware corporation in 2016. Hanchett is an engineer, and his background prior to Atlis was in law-enforcement technology development—with some product development and management experience.

Atlis XP electric truck concept

Despite the seeming impossibilities of the company’s goals, Atlis has relied on a regular flow of video updates showing progress on the Atlis platform and truck “buck” plus, plus a team of established professionals with experience at other EV makers to vouch that this isn’t vaporware. That includes impressive resumes relating to electric vehicles. Huda Almashhadany, who is head of battery development, was the former battery lead at Byton and Faraday Future. Chris Dawson, who was a manufacturing equipment engineer at Tesla through the Model 3 launch, is heading XP platform development. And Rob Healey, who heads up the energy group, was formerly the infrastructure manager at BMW through the i3 launch.

The biggest impossibility: the megawatt charging network

Another big push required to support such trucks is a charging network. Hanchett said that the CharIn (CCS) consortium that’s working toward a 1 to 3 MW standard for electric commercial trucks will result in another inconsistent experience. “And that, to me, is the non-acceptable approach,” he said, noting that owning the ecosystem is the key to success. “So we are still going down the path of developing the solution.”

Atlis plan: electric truck, platform, charging

To add just a bit of context for the moment: Tesla has put billions of dollars into the development of its Supercharger network since 2012, and it’s balked at taking on the megawatt-level charging hurdles of its Semi alone. In October it said it’s looking to deploy infrastructure with other parties, with the intent to settle on such a megawatt standard that could charge a truck quickly enough during breaks.

Atlis is using the same funding mechanism as Elio Motors—a Regulation A public offering. Although Elio’s product and vision were much more modest, it was also Arizona-based and had a similar initial philosophy of vertical integration and designing its own components (like the engine), as well as a game-changing business model that would have paid off the car over time through gasoline purchases. Elio took reservations and various forms of investment for most of a decade—including, like Atlis, frequent social and email pushes asking for more money—until going dark sometime in 2019.

Elio Motors founder Paul Elio at New York Auto Show press conference, Apr 2015

Hanchett must be used to the comparison, as an FAQ on the company’s site says: “No, fortunately, we are not in any way affiliated with Elio Motors. We differ in almost every respect.”

When asked by GCR about the fundraising hurdles and the seeming impossibilities of the model without additional major investment capital, Hanchett seemed remarkably unfazed by the challenges. He noted that he doesn’t come from the industry, or from a wealthy background, and so chasing after big equity investors presented its own challenges—and he expresses genuine enthusiasm when he talks about the idea of a company that’s essentially owned by those who have an interest in the tech.

Some cost realities

It’s widely accepted that all-new vehicles on a new platform will cost about $2 billion to develop—significantly less if, like Bollinger Motors, the company plans neither for mass production nor light-vehicle standards. Bollinger, for instance, has planned its vehicles as Class 3, meaning that they won’t be held to some of the same safety standards as light vehicles.

Bollinger reveals modular battery layout, patent filing

Batteries and drive systems also take big money to develop. Byton, which had funding adding up to more than $1 billion, told us that it had to opt for off-the-shelf motors and cells so as to prioritize its resources to get its platform developed and its M-Byte to market—and that’s been fraught.

Hanchett is aiming at mass production, though; he discussed tens of thousands in the near term, potentially hundreds of thousands later, with the aim to build vehicles itself rather than contract it out—and that’s a much higher financial bar, especially with no factory developed. For instance, the first phase of Lucid’s $700 million electric vehicle factory alone cost about $300 million, enough to make 30,000 vehicles, not including battery and power systems, and covers 999,000 square feet.

Ford E-Transit and F-150 Electric prototype

Atlis has some very good ideas—particularly around the simplification of platform components, in something that might be used for an urban delivery vehicle all the way up to a light- or medium-duty Semi. However this modularization isn’t unlike Ford, which is using the same motors and drive units for its upcoming F-150 Electric as for its E-Transit electric cargo vans.

There are some examples of companies that got to “the next level” with crowdfunding as a start. Munich-based Sono Motors, for instance, got a round of private investment last year that will get their solar-supplemented car to production.

Atlis XP modular electric car platform

Atlis plans to reveal a next prototype of the XT yet this quarter. Hanchett says that the platform itself is ready to produce today, and that work on the battery and charging front continues. What will it deliver this year, or in 2022, and how?