This week is the heart of tax time.

If you're like many other taxpayers or a small businessperson, right about now you're looking up the 2010 mileage rate that the IRS lets you use when deducting personal-vehicle use as a business expense.

So here's the answer: The IRS mileage rate is 50 cents per mile for business miles driven during the 2010 tax year.

You also get to deduct 16.5 cents per mile driven for medical or moving purposes, and 14 cents per mile for distances you drive while on charitable pursuits.

But whether those rates cover your costs or not is a different question. One way to improve your odds of making money on the mileage reimbursement is to do all your business driving in the highest-mileage car you can buy.

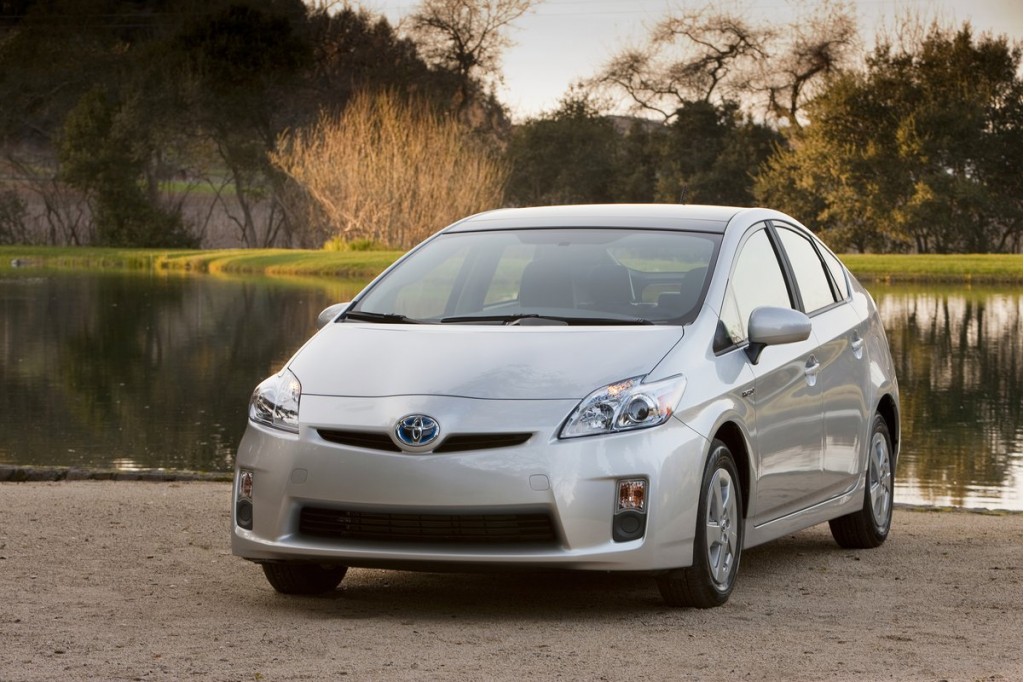

2011 Toyota Prius

For the current year, the 2011 Toyota Prius--with an EPA combined gas mileage rating of 50 mpg--would be that car.

But plenty of other vehicles offer at least 40 mpg highway mileage, which helps most if you cover a lot of miles at high speeds.

For any of those cars, the IRS mileage deduction may exceed your costs per mile, since fuel costs represent a huge chunk of a car's total cost of ownership.

Consider that if gasoline costs $4 per gallon, a 20-mpg car uses $20 in fuel every 100 miles. That Prius uses just $8. But if you can deduct those 100 miles for business at the IRS mileage amount, you get the same $50 deduction either way.

Whether your car payments, insurance, and other costs let you break even or make back a bit of cash depends entirely on your personal circumstances.

But if you charge 5,000 miles a year as a business expense, that fuel-cost differential alone adds up to $600.

Which could be the difference between breaking even and turning a profit on the IRA reimbursement rate that gives you a $2,500 deduction.

Think about it.

The IRS has already issued its 2011 mileage rates for the current tax year, by the way. They are 51 cents for business, 19 cents for medical or moving, and 14 cents for charitable work.

As always, get your tax advice from a professional. And, as they say, your mileage may vary--meaning we don't do tax advice here. We just advocate for drivers to buy the most fuel-efficient vehicle that meets their needs.

+++++++++++