Automotive innovation rolls out over many years, usually decades, and usually only a few companies lead.

Others hang back, waiting to see if buyers will accept new features, new powertrains, and new types of vehicles.

More than six years after modern electric cars hit the market in volume, many automakers are only now deciding on their strategies.

DON'T MISS: Has GM really 'already lost' the electric-car race to Tesla?

General Motors, however, is quite clear on its goal: it wants to be the first car company in the world to sell large numbers of electric cars profitably.

That's the news delivered separately by GM CEO Mary Barra and its product chief Mark Reuss in recent weeks, according to The Detroit News.

Within the industry, it's widely accepted that any new powertrain technology will likely take more than one model cycle to break even.

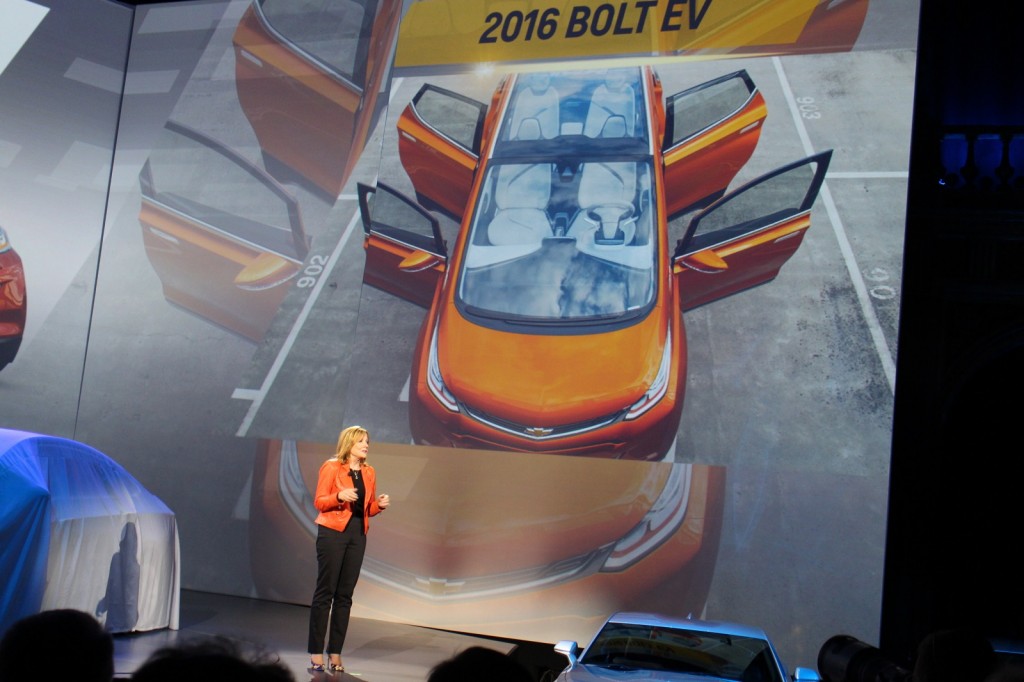

GM CEO Mary Barra and Chevy Bolt EV electric car image at 2016 Chevrolet Cruze launch, Jun 2015

Toyota is universally assumed to have lost money on every first-generation Prius hybrid it built from 1997 to 2003, and only started to turn a profit somewhere during that car's second generation from 2004 to 2009.

Lower-than-planned sales of the Nissan Leaf over its seven-year life are widely assumed to have lost money for its maker.

And while Tesla Motors claims to turn a profit on its Model S and Model X luxury electric cars, those vehicles have not generated anywhere near the cash to invest in future products and expand its production.

Tesla has lost money continuously for more than 12 years, save for two marginally profitable quarters, sustained by injections of more than $2 billion in venture funding and stock sales.

“Our internal focus is to make GM the first maker of profitable, highly desirable, range-leading, and obtainable electric transportation,” CEO Barra said last month in the company's first-quarter earnings call for investors, analysts, and media.

Reuss called the goal the "mantra" of product development, though he wouldn't project when that could be achieved.

2011 Chevrolet Volt outside Detroit-Hamtramck assembly plant

GM's ability to sell electric cars at a profit, the News notes, largely depends on how fast the cost of the lithium-ion battery cells it uses in the Chevrolet Bolt EV and Volt plug-in hybrid declines.

Reuss famously said it would pay $145 per kilowatt-hour for the cells that went into the very first Bolt EVs off the line last year—to the apparent dismay of its cell supplier LG Chem.

But to get the base price of a Bolt EV down from $37,500 to something like $25,000 will require substantial further declines in cell cost

CHECK OUT: How Much And How Fast Will Electric-Car Battery Costs Fall? (Mar 2012)

More than 20 years of data indicates that small "consumer format" lithium-ion cells have fallen at an average of 7 percent a year. Since 2010, the declines in larger cells used in vehicles have exceeded that rate.

Previously, GM had said it hoped to hit a cost of $100 per kilowatt-hour by 2022. More recently, Reuss expressed confidence that "we'll be there before then, I know we will."

Whether those cars will be priced comparably to similar vehicles with combustion engines, however, wasn't clear.

Chevrolet Spark EV at CCS fast charging station in San Diego.

Most long-term analyses of the industry support the view that such a decline will inevitably bring electric cars to parity with conventional vehicles.

According to a recent article by Bloomberg, European supplier Continental AG, the year will be 2025.

“High battery costs, limits to driving ranges, and charging times," said the company's CFO Wolfgang Schaefer, "mean that electric cars won’t have an economic advantage over combustion engines until 2025."

The year will vary for different makers, too.

The high volumes and decades of experience among GM, Nissan, and Tesla are likely to drive their costs lower than those of makers just starting out with their first volume electric cars.

President Barack Obama looks at 2017 Chevrolet Bolt EV electric car at Detroit Auto Show, Jan 2016

Whatever the year, however, it's now on paper: GM intends to be one of the first companies in the world to make money selling electric cars.

Which, frankly, would be a plus for the entire segment.

_______________________________________