Widespread electric vehicle adoption depends on public charging—of all sorts, from overnight streetside or parking-garage connectors to road-trip fast-charging.

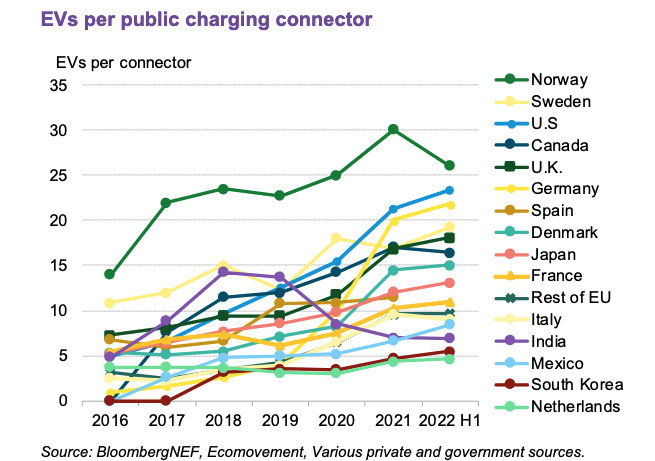

Thus, the ratio of registered EVs to public charging connectors is important. It can’t get too high, or EV drivers won’t have the confidence that they’ll find a connector where and when they need it. Charging can’t get too far ahead of the vehicles, or the upkeep of underused stations might fall away—part of ”utilization,” in the jargon of the industry. It’s a balancing act.

It also varies a lot by country right now, and there are times in which the charger buildout will get ahead of EV adoption and vice versa; the important piece is that it doesn’t get too far behind.

Based on data compiled recently by Bloomberg New Energy Finance, there’s just one public charging connector for every 23 registered EVs. The U.S. and Norway are among the countries with the fewest public charging connectors per registered EVs. South Korea and the Netherlands, on the other hand, offer the most public connectors per EV.

EVs per public charging connector, by country - Bloomberg New Energy Finance

BNEF pointed to access to home charging and the utilization of existing infrastructure as influencing factors. Both the U.S. and Norway do likely have a higher proportion of single-family homes, while public charging is more critical for nations with a high rate of apartment-dwellers.

China aside, in raw numbers, the U.S., Netherlands, and France have the most public EV charging connectors, at 122,000, 98,000, and 82,000 respectively.

Future-proofing EV growth

Another good way to think about it is by looking at how the charging infrastructure is growing to accommodate a vastly more electric fleet in the future. Relative to the size of their vehicle fleet as a whole, the Netherlands, Norway, and Sweden have the most chargers right now.

The BNEF data rounds up figures from ZEV Transition Council member countries—North America plus much of Western Europe, the UK, India, Japan, and South Korea—which together account for 42% of global passenger-vehicle EV sales in the first half of 2022. Separately, China accounted for about 53%, while China and Europe together accounted for 84% of global EV sales.

Globally, there are now more than 21 million passenger EVs on the road, with 47% of that fleet in China and 32% of it in Europe.

Tata Tiago.ev

India is especially noteworthy. Although it has relatively few public charging connectors, EVs remain just 0.1% of the fleet there. Over the past few years, it has accelerated charger installations ahead of the arrival of more plug-in vehicles, and the trendlines could soon change with the introduction of a number of affordable EVs in recent months—including the $10,000 Tiago.ev.

Other countries are embarking on some mammoth projects to make sure that those without home charging aren’t left behind. South Korea’s capital Seoul, for instance, just confirmed that it plans to install more than 200,000 urban EV chargers over the next four years, assuring that residents will never be more than a five-minute walk from one.

U.S. in a growth phase

There are plenty of indications the U.S. is accelerating its rate of growth of public chargers—including the recent confirmation that all 50 states now have plans approved to start installing EV charging hardware on the way to a U.S. network that will eventually include 500,000 chargers. The initial deployment is to be laid out as fast-charging, on highway routes designated Alternative Fuel Corridors, but more urban charging will follow.

Chevrolet Bolt EV charging at EVgo DC fast charge station

There are a number of indications the U.S. is on the cusp of a growth phase in terms of infrastructure buildout—beyond just the glamorous fast-chargers on the side of the highway. The infrastructure plan, plus those like GM’s push to install 40,000 destination chargers in communities, IUC’s plan to install 6,000 EV chargers in Florida, and various utility-led initiatives for multi-family buildings and workplaces are all examples of the bigger build-out.

Considering the U.S. fleet of about 290 million passenger vehicles, will the rate of public charger growth keep up with the rate of EV adoption? That remains to be seen—and it’s a critical piece toward making sure that growth doesn’t get held back in the long term.