General Motors CEO Mary Barra announced an accelerated sustainability push for the automaker Wednesday during a presentation for investors, and showed no sign of backing down from the company’s plan for an all-electric future that's out of sync with the talking points from either California or the Trump administration.

“We believe climate change is real,” said Barra. “It’s a global concern, and the best way to remove automotive ambitions from the environmental equation is an all-electric, zero-emissions future, and it needs to be done on a national level and then a global level.”

Barra then took the statement beyond platitudes, and doubled down on the company’s controversial position made last fall against California’s Clean Cars program as a separate rules framework. GM sided instead with a group of automakers asking for a single national framework.

“We believe that the national zero-emissions vehicle program that we have proposed across all 50 states will help accelerate the transition to EVs and all the benefits that come to the environment and society,” she said, outlining that such a plan would make the U.S. a leader in electrification, create economic growth, and make EVs affordable faster. “If we want true electrification across the country—which we do—we need the infrastructure, the education, and the incentive programs to all align and work together.”

National plan or not, an all-electric future?

GM made a proposal for such a thing—the incentive part of it. In October 2018, it outlined a structure for a national ZEV-credit (NZEV) program that would be used to mandate a certain portion of the U.S. fleet to be made up of fully electric vehicles. Under GM’s proposal it suggested a 7% credit requirement in 2021, with a 2% boost per year up to 15% in 2025—then to 20% in 2030, with a program end at 25% or at some point when it’s determined that targets “are not practicable within the timeframe.”

2017 Chevrolet Bolt EV pre-production

In that plan, vehicle credits would have the same kind of transactional value they do now—and they could be banked toward future years or traded with other automakers. EVs deployed as autonomous vehicles would get six times the credit amount and those deployed in ride-share programs would earn 1.75 times the credits. Vehicles weighing more than 5,250 pounds would earn 1.5 times the credit amount to recognize the additional displaced fuel.

It's also important to underscore that ZEV credit percentages do not at all equate to fleet percentages—so even at a 25% program end the actual percentage of EVs sold would be a fraction of that.

Nevertheless, GM says that the U.S. market would reach 1.1 million annual EV sales by 2030 under its NZEV scheme, with a cumulative 7.1 million EVs on the road by then from it.

“Our proposal is a framework in hopes of starting a dialogue and we still would like to see a conversation around this,” said the company’s public policy spokeswoman, Jeannine Ginivan.

Uneven incentives and targets—and Tesla

The plan (and even the conversation) might have fallen on deaf ears in Washington, D.C. Latest reports indicate that a draft of the final rule goes with a 1.5% annual increase in fleet fuel economy—a step up from the freeze that the Trump administration had originally planned, but with no change in how EVs, hybrids, and other technologies are treated, certainly no victory for those who intend to spend big on electric.

The EPA hasn’t yet acknowledged the GM plan publicly, but in the following response to Green Car Reports it hinted—obliquely—that a response to GM or a mention of GM's plan is due: “The agencies will review public comments before taking final action. As with all substantive public comments submitted on proposed rules, when the final rules are issued, the agencies will respond to all such comments received.”

Support for many of the policy changes that would help GM's EV rollout has been thin in Washington. The automaker lobbied earlier this year for an extension and restructuring of the EV tax credit that would have lowered the amount slightly and given it a longer runway. Despite some bipartisan support that extension was cut from the federal spending bill passed in December due to "extreme resistance" from the White House, according to a Bloomberg report.

GM also remains far from its (admittedly hypothetical and via distorted ZEV-credit calculations) 7% starting point today. It sold 16,418 Bolt EVs in the U.S. in 2019—a little over 0.5% of its total sales. If GM chooses to practice what it preaches, assuming its sales are roughly the same as in 2019, it would require moving many times than number of EVs per year.

Tesla factory, Fremont, California

To put that in perspective, Tesla delivered an estimated 223,200 fully electric vehicles in the U.S. in 2019, according to Automotive News.

“We strongly believe that focusing on interim technologies, such as hybrids, and multiple solutions for multiple states, actually slows the adoption of full battery electric vehicles,” Barra added.

That last comment may continue to be a sticking point for GM for some time, as it’s already hit the 200,000-vehicle ceiling for EV tax credit eligibility. Other automakers that have been more conservative about plug-in vehicles will be able to use that as they roll out EVs over the next few years.

“I am more convinced than ever that we need one national standard,” Barra said later in her presentation. “We’re talking about a fundamental shift in transportation as we know it.”

Other priorities underscored by the CEO included home, workplace, and public charging solutions, EVs with at least a 300-mile range, and pricing for them that’s on par with internal-combustion vehicles.

GM Lordstown, Ohio, factory

Barra also mentioned that its partnership with LG Chem—with yet-unannounced details for an Ohio operation—will help make EVs more affordable. “With every battery improvement we get closer to cost parity,” she said.

No pause in stepping up sustainability

While the automaker likely won’t discuss EV volume targets for some time, it has stepped up some sustainability measures. Barra said that the automaker will source all of its global electricity from renewables by 2040. That’s a decade earlier than the company had previously aimed for—even as of its last sustainability report.

To that goal, Barra said that by the end of 2019 it will have 23 sites completely powered by renewable energy, and by the end of 2021 it will have 28 sites on renewable energy—including its global tech center. By 2025 it expects to be 60% of the way (globally) toward the full goal.

GM will also boost the number of automotive parts with sustainable materials that it uses for its vehicles and aim for sustainable content of at least 50% by 2030.

For batteries, Barra said the company is convinced of their long-term value and are an asset to the company, which is in line with other statements made by established automakers who are investing big in EV platforms.

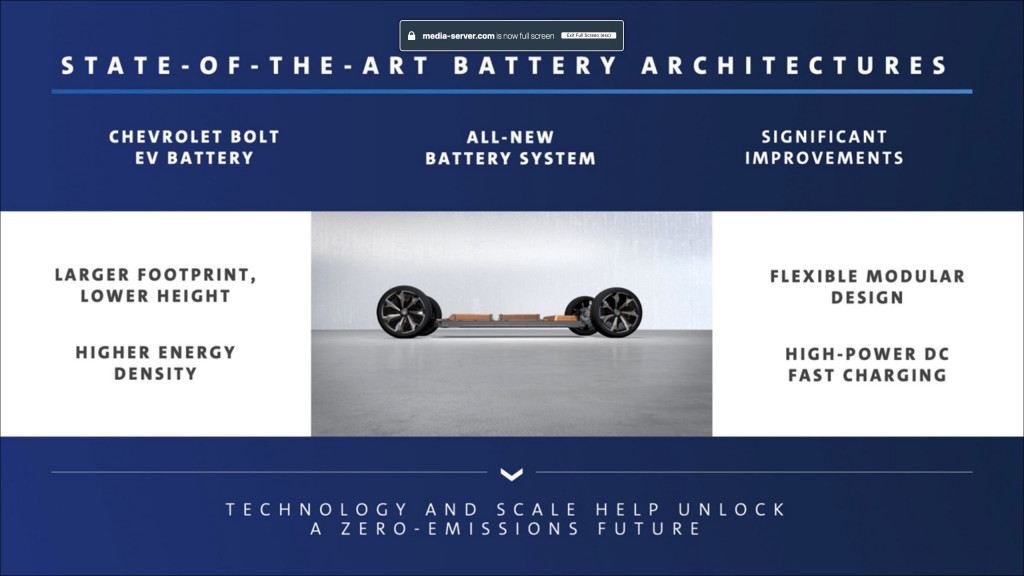

GM BEV3 battery architecture

Perhaps the best indication that GM is ready to step up on volume came from company president Mark Reuss, who said that GM “will introduce multiple products a year...as the market dictates.”

“If the customer wants a basic package, we’ll have that. If the customer wants true off-road capability and towing capability, we’ll have that, too,” Reuss said, insisting that the electric-truck project won't mean just one pickup and will be scalable across multiple brands.

Now, it seems, national plan or not, GM just needs to deliver the evidence it’s wholly in on this electric future.