All the stories about sensible types who waited in line or jumped through hoops to pay huge price premiums on a new electric vehicle?

Call them outliers for now, as a new study verifies that EV buyers less likely to take on outsized levels of debt than those purchasing traditional gasoline-powered vehicles.

The study, from the credit giant TransUnion, with S&P Global Mobility, and combining the former’s credit data with the latter’s vehicle registration and forecasting, couldn’t be more comprehensive in size and scope. The mammoth-scale data crunch looked at approximately 33 million U.S. consumers who bought new vehicles from 2019 to 2021.

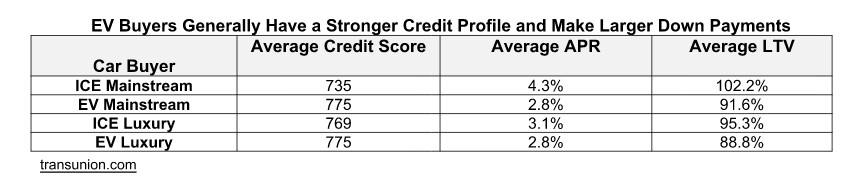

All in, EV buyers had such better credit that they jumped the divisions between mainstream and luxury sectors. What TransUnion considered to be EV mainstream buyers had a higher average score than internal-combustion-engine (ICE) luxury buyers—775 versus 769, respectively.

EV vs. ICE credit profile - TransUnion

A sizable difference in credit scores translates to a huge difference in the terms of the loan and, ultimately, what the customer can afford. According to TransUnion, a credit score of 735—the average for an ICE mainstream buyer—corresponded with an average APR of 4.3%, while the 775 average for an EV mainstream buyer meant 2.8%. That connected to an average loan to value rate—the percentage of the total loan amount versus the vehicle price—of 102.2% for the ICE mainstream buyer versus 88.8% for EV buyers.

Yes, that means EV buyers are also making bigger down payments.

And the lower-risk credit profile seemed to go beyond the factors that traditionally go into credit ratings. Even comparing EV and ICE buyers with the same credit score, the EV buyers had lower “serious delinquency rates.”

2023 Hyundai Tucson Plug-In Hybrid

TransUnion hasn’t provided a breakdown on how it divided the mainstream and luxury markets. But it was clear that it filtered out buyers of plug-in hybrids and was built on the expectation that the market for fully electric vehicles will grow from about 5% today to about 40% by 2031.

“While Tesla dominates the market today, it’s predicted to fall below 20% of market share by 2025 as new makes enter the EV space,” the study said.

Working around a price rift that probably won’t last

Today, there’s a gigantic price rift between ICE vehicles and EVs that gives EVs a bottom line closer to luxury models—perhaps because many of them are luxury models. According to Kelley Blue Book, the average new car in America now costs more than $48,000, while the average cost of an EV is around $67,000. With electric vehicles and ICE models expected to reach a price parity by mid-decade, it’s an anomaly that likely won’t last.

The conclusions about credit risk and demographics confirms anecdotal comments that a number of executives have made about the buyers of their mass-market electric vehicle models. Hyundai executives have, for instance, noted that the Ioniq 5 electric SUV is drawing early buyers who could have afforded a much more expensive luxury vehicle.

2022 Hyundai Ioniq 5

As a supplement to the large-scale data itself, the firms did a survey of about 1,500 U.S. vehicle owners regarding which EV buyers were most interested in, plus shopping and finance preferences.

The survey found that a higher rate of EV shoppers do research on vehicles and financing online—with double the rate (32% versus 16%) completing financing online.

That means EV owners are far more likely to understand—and want to understand—what they can afford ahead of hands-on shopping.

Is low-risk behavior always a positive to dealerships?

That said, it remains debatable as to which entities like dealerships, captive credit companies, or separate lenders see this as a positive—and, to the point, whether those with pristine credit are the most likely to either generate the most profit for the dealership or to be repeat buyers. Dealers often run on a particular percentage markup versus the bulk rate negotiated for buyers in certain risk pools, pre-negotiated with the lenders.

Meanwhile, those with better credit scores are more likely to cross-shop, and to be more aware that there’s a markup, while those with lower credit might also perhaps be more likely to impulse-buy—and opt for vehicle appearance options or accessories that the super-sensible, top-credit types might not.

Honda future dealership design for selling EVs - 2022

The TransUnion conclusions even lay out opportunities for dealerships that some makes are currently leaving on the table: “More than half of EV owners/considerers would like to finance their next EV home charging station,” it says.

For years, dealerships have been hesitating about putting the additional time and resources into selling and supporting EVs, but to us, this study underscores yet another reason why they could be focusing more attention on them.