Last week, in a speech to executives in Germany, Volkswagen CEO Herbert Diess was critical about the automaker’s pace so far toward electric vehicles.

Diess underscored, according to the Financial Times, that shifting to electric vehicles would require “a radical change of direction”—to more of a tech company.

Meanwhile, an analysis released last week by the respected consultancy Wood Mackenzie projects that VW will reach a cumulative 14 million electric vehicles by 2028, which will make it the world’s largest maker of EVs by the end of the decade.

That projection is far below VW’s own electric-vehicle goals, which last year were revised upward from 22 million to 28 million (and 70 different EVs) by 2028—across the full Volkswagen Group, with more than half of them in China.

By 2025, Volkswagen plans to sell 15 different Chinese models employing its MEB platform. That’s when global electric sales for the VW brand alone are targeted at 1.5 million, with about 3 million EVs for the whole VW Group.

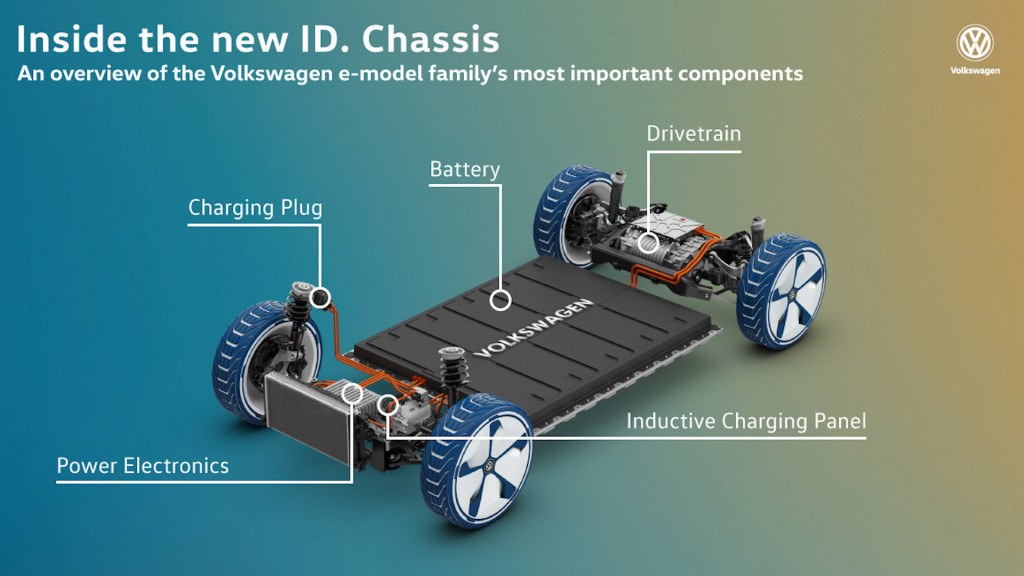

VW MEB platform

Wood Mackenzie says that to sell 22 million EVs by 2028, VW would need to take a 53% share of the global EV market and 57% of all EV battery production—”something that would prove to be extremely challenging,” the firm notes.

The estimate of 14 million EVs would equate to 27% of global EVs and 30% of the world’s EV battery supply, according to the firm.

VW needs to ramp up production soon, or it risks incurring large fines from the EU. It's already producing its ID 3 for Europe, but deliveries haven't yet begun.

Volkswagen MEB platform architecture

Amid this, VW appears to be shoring up its battery supply. Last week Reuters reported that Volkswagen was in advanced talks to buy up to 20 percent of the Chinese battery company Guoxuan.