Ten days ago, a website appeared from Wanxiang America, the new owners of Fisker Automotive, under the title of "The New Fisker."

The site included a comprehensive timeline of the formerly bankrupt company's past, warts and all: from the lawsuit by Tesla Motors against Fisker through the May 2011 suspension of funds from its U.S. government loan through to cofounder Henrik Fisker's resignation and ensuing staff layoffs.

MORE: 'New Fisker' Website Launches As Wanxiang Prepares To Restart Electric-Car Maker

But while the timeline has many entries, it's not entirely complete.

Henrik Fisker

Or as one electric-car industry observer said, "It's interesting both for what it includes (the Tesla lawsuit, really?) and what it leaves out."

Indeed, a careful reading shows that there are significant events--and players--missing in the long and convoluted saga of the sexy but troubled range-extended electric luxury sedan and the startup company that built it.

Missing $1 billion?

For instance, the early private equity capital that funded Fisker for its first few years--private investment ultimately totaled roughly $1 billion over several successive rounds--goes entirely unmentioned.

So does Kleiner Perkins, the fabled Silicon Valley venture-capital firm that served as lead investor and the highest-profile backer of Fisker. (It also invested in EEstor and a couple of other unsuccessful startups in the automotive and energy storage field).

Kleiner Perkins partner Ray Lane even took part in a staged press event in July 2011 to mark delivery of the so-called "first production Fisker," though that car was actually a factory vehicle, and other customer deliveries didn't start for several more months.

MORE: Who's Still Buying Brand New Fisker Karmas, And Why?

In fact, the first funding that's mentioned on the New Fisker timeline is the $529 million low-interest loan awarded by the U.S. Department of Energy in September 2009.

But it's not until April 2012, in the mention of a $392 million secondary placement, that any private funding appears in the picture.

Cell maker A123 missing

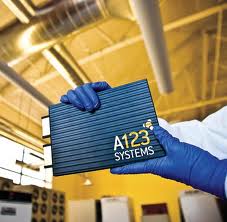

Nor is any mention made of A123 Systems, the high-profile lithium-ion battery startup in Massachusetts whose cells were used in the Karma's battery pack.

A123 Systems Prismatic Cell

The July 2012 shutdown of all Karma production appears, but there's no mention of A123's March 2012 recall of cells made at its new (and Federally-supported) Michigan battery plant, a major glitch that affected hundreds of already-built Karmas.

That battery flaw was likely what caused a Karma tested by Consumer Reports to die during a track test, producing one of several very negative articles about the car.

That recall required Fisker to recall those cars to install new batteries, and its cost likely contributed to A123's own bankruptcy in October 2012.

But perhaps Wanxiang wishes to downplay A123's role in Fisker's failure, since it now owns not only Fisker but also the battery maker.

Fisker, A123: same new owner

Wanxiang bought A123 out of bankruptcy in early 2013; at least one Fisker insider has said privately that A123's inability to provide cells to restart Karma production after that point was a major contributing factor in Fisker's failure.

In fact, A123 systems and its lithium-ion cells appear nowhere on the timeline.

As always, history is written by the victors.

Fisker, however, received extensive coverage in the automotive and technology media--so many of the missing pieces are available to those who search.

It will take time to see if Wanxiang's version of Fisker's history may well be the one that goes down in the record books.

But it's worth noting what the new owners have included--and what they've left out.

_______________________________________________