With gasoline costing 40 percent less than it did just six months ago--and under $2 a gallon in many states--you might think this would be a good time to discuss raising the Federal gas tax.

You would be wrong.

The Federal gas tax hasn't risen since 1993, and the U.S. Highway Trust Fund has been officially broke for several years now.

DON'T MISS: Highway Spending Bill To Bar Hybrids From Carpool-Lane Incentives? (May 2014)

Every one of the 50 states now gets back more in Federal road and highway funding than it sends to Washington, D.C.

If it had kept pace with inflation, its current level of 18.4 cents a gallon would now be 30.1 cents.

Moreover, the deficit in funds to achieve a 'state of good repair in the nation's bridges, roads, and highways now totals in the hundreds of billions of dollars.

Utah highway

Federal highway funding routinely now gets extended a few months at a time. The latest patchwork solution extends only until May.

In today's anti-tax environment, a gridlocked Congress is seemingly no closer to a solution than it was several years ago--and by now quite accustomed to kicking the can a few months or a year down the road.

And according to an article Friday in The New York Times, there is "little support" for raising the Federal gas tax to fund such work on a long-term basis.

ALSO SEE: 12-Cent Rise In Federal Tax On Gas, Diesel Proposed By Pair Of Senators (Jun 2014)

Continually improving fuel economy has meant that new cars use less gas to cover the same miles--lowering gas-tax revenue.

The corporate average fuel economy standards signed into law in 2009 and 2010 have only exacerbated the situation.

The real-world average gas mileage of new vehicles sold today hovers around 25 mpg, and it will have to rise to about 42 mpg by 2025 (or 54.5 mpg in CAFE math).

2014 BMW i3 REx range-extended electric car owned by Tom Moloughney - on the highway

Last June, Senators Bob Corker [R-TN] and Chris Murphy [D-CT] proposed a pair of consecutive boosts in the Federal gas tax of 6 cents per gallon in each of two years.

“If something like this is going to be done, now is the time to do it,” Corker told the Times.

According to an official at the U.S. Chamber of Commerce, many Congresspeople favor raising the tax in private--but fear retribution at the polls.

MORE: Should Higher Gas Mileage Come With Higher Gas Taxes Too? (Jun 2009)

Meanwhile, newer methods like a tax per mile traveled aren't yet ready to be rolled out on a widespread basis--and raise privacy concerns over tracking and government collection of data on individual movements.

An alternative would be transferring highway funding into the general Federal budget, though many oppose that step.

Another is taxing oil itself by the barrel--which would impose road-maintenance costs on other categories of users, including those who heat their homes with oil.

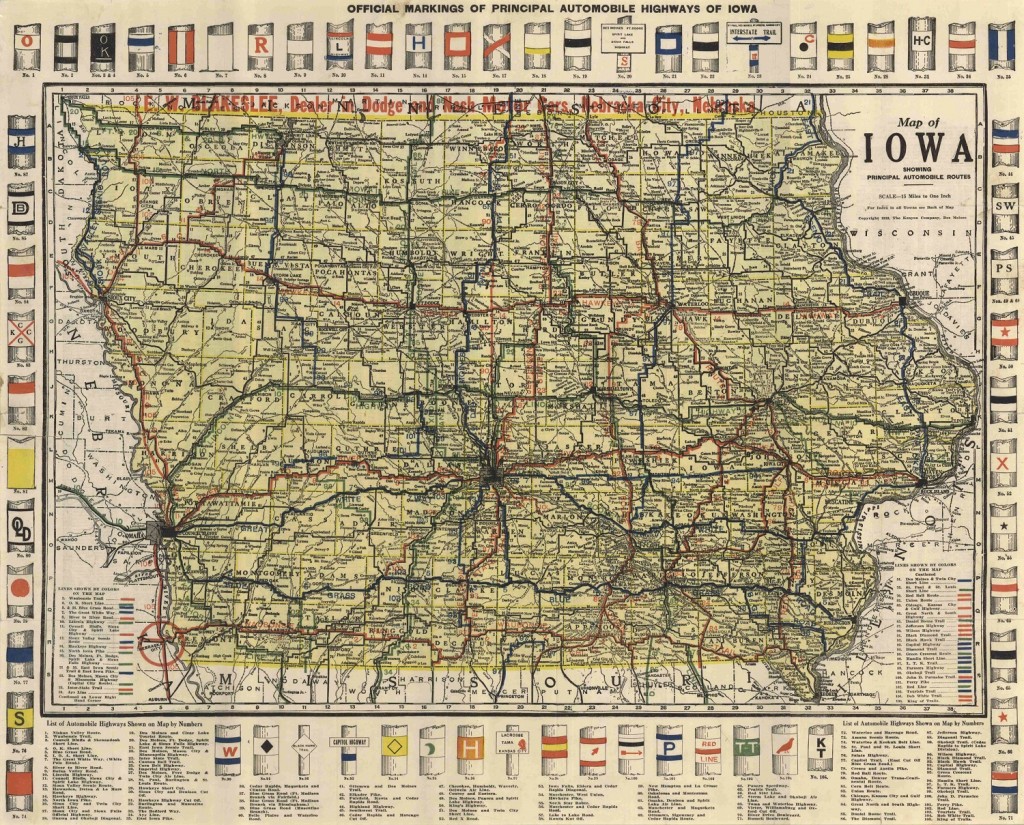

A map of auto trails and highways in Iowa in 1919

When the Republicans take control of both houses of Congress later this month, an overall tax reform package is expected to be on the docket.

Corker says he's open to alternatives to provide a long-term funding stream for highways, but not to more short-term fixes.

Stay tuned.

_______________________________________________