Yes, the electric vehicle price war has likely begun.

Last month’s Tesla price cuts slashed up to 20% of the cost to buy the EV maker’s vehicles. Then in a rare move, Ford dropped prices on its Mustang Mach-E lineup last week by up to 9%.

Those first dramatic shots over the bow are almost certainly not the end of it. Recent financial updates from Ford, Tesla, and others suggest that there’s growing pressure to cut prices on EVs—or at least to stop raising them.

Automaker executives and industry analysts have made some more sobering remarks about what that means. Among them: It will take cost cuts for parts, better manufacturing efficiency, and, in some cases, ramped-up production of gasoline trucks to get there.

In a U.S. market report released last week, S&P Global Mobility underscored an important point—effectively, that legacy automakers, particularly the U.S. Big Three, need cash-cow profits from full-size pickups to support their investments in EVs.

2023 Ford F-150 Lightning

Putting the EV ramp on ICE

“GM is the only one of the three that has incremental capacity to produce more full-size pickups—whether they're ICE or BEV,” said S&P Global Mobility. “Ford is capacity-constrained until Blue Oval City comes online in the second half of 2025, and Stellantis has their own limitations in the short term.”

S&P also underscored a different reason, in addition to higher interest rates and weakening demand in general that will pressure prices to drop: Many owners of vehicles bought over the past couple of years owe more than the vehicle will be worth on trade.

“These vehicles are all underwater,” said Dave Mondragon, S&P Global Mobility’s VP of product development. “They were sold at record-high prices with no discounts, and there will be little to no equity to roll into a new vehicle."

The pressure to be more competitive on EV prices in turn adds pressure on companies to ramp up EV production to answer demand, and reach profitability on EV models sooner.

Automotive supplier companies are bracing for added pressure from automakers to reduce costs after remarks made during financial calls over the past couple of weeks. Tesla CEO Zachary Kirkhorn said that it was “attacking every other area of cost,” pointing to suppliers specifically.

2023 Tesla Model Y - Courtesy of Tesla, Inc.

Lingering production issues

Companies are still dealing with a range of issues preventing them from selling EVs in the numbers intended. Nissan will reportedly deliver fewer of its Ariya electric vehicles over the next few months than U.S. dealers had expected, due to the after-effects of chip shortages.

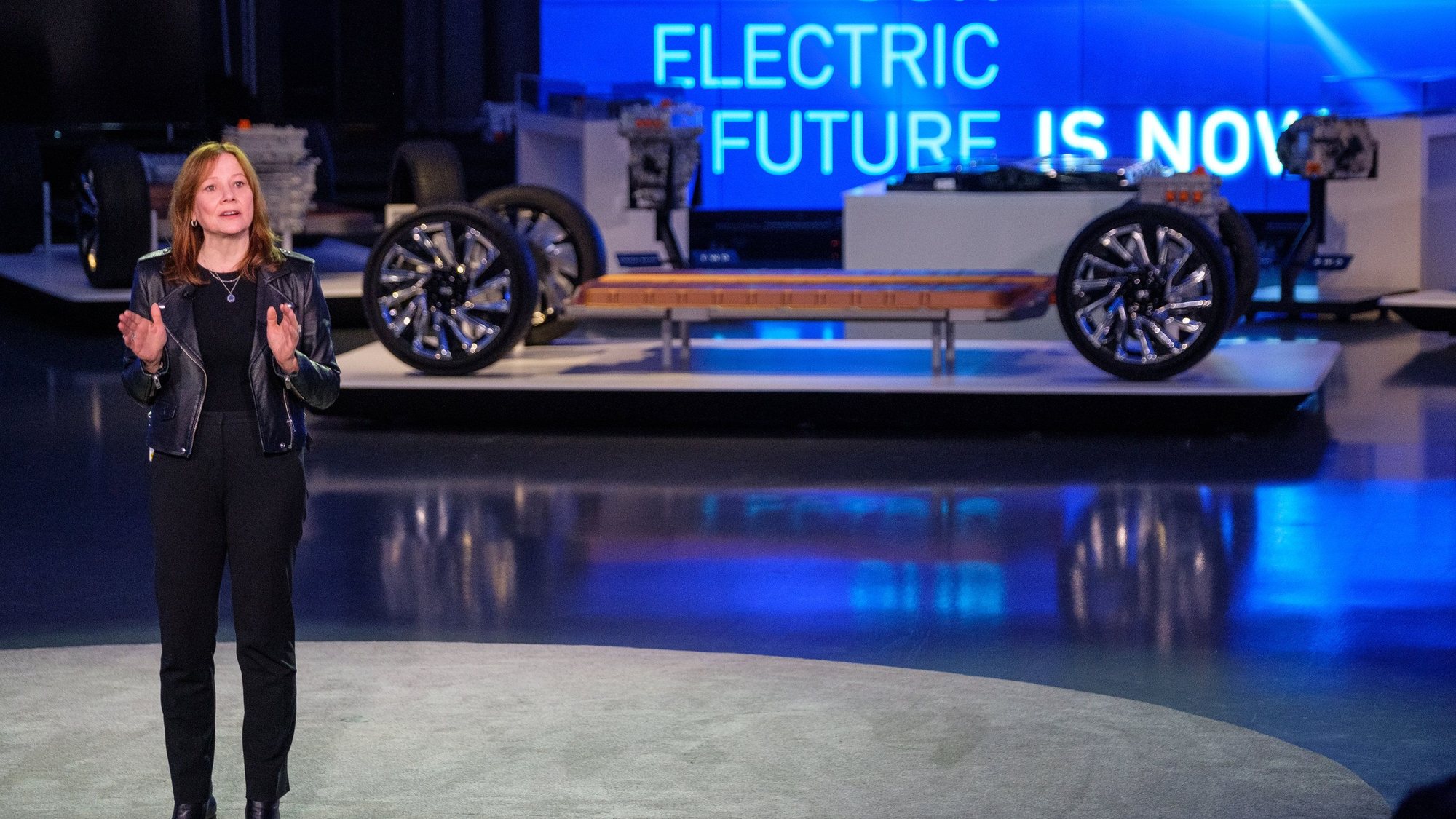

GM appears to be held back somewhat by the ramp up of its own battery production, through its Ultium Cells LLC joint venture with LG. CEO Mary Barra confirmed this past week that its target of 400,000 cumulative EVs for North America had been pushed back to mid-2024, rather than the end of 2023 as it had said previously.

Barra pointed to issues with staffing at the Ohio battery plant, which is the first of three North American battery plants dedicated to producing the same large-format pouch cells developed with LG. A fourth battery plant hasn’t yet been detailed, and the company underscored that it’s flexible on battery cell format despite its investments.

2024 Chevrolet Equinox EV

GM, amid that update, pointed to the planned launch, in the second half of this year, of its Blazer EV and Equinox EV models, the latter of which is due to start around $30,000.

As Automotive News reported last week, Volkswagen has no plans to counter these recent price drops. That’s somewhat in conflict with what VW has said in the past, as price flexibility was always one of the purported advantages of its MEB platform for millions of EVs.

2023 Volkswagen ID.4

Volkswagen Group cousin Porsche is considering an EV price drop, however, according to the AN report, while Renault’s brand boss expressed concern that cutting sales by 10% or more within a week affects residual (resale) values and hurts existing customers.

Tesla is once again pushing for huge production gains in 2023, and it continues to rejigger pricing faster than the industry typically reacts. For instance, it introduced a $1,000 price hike on the Model Y this past week, just after an EV tax credit clarification from the Treasury Department that made the whole Model Y range eligible.

Prices drop a little bit, EV demand goes way up

Big-picture, EV interest and demand is showing no signs of abating. But as Tesla has recently illustrated with the surge of demand accompanying its price drop, it’s closely tethered to price and there’s tremendous pent-up demand for a wider range of affordable EVs.

Ford Mustang Mach-E at Port of Drammen, Norway

Outside of Tesla, each of the full-line automakers will need novel solutions to hold or lower prices, as well as ramp up production of their existing EVs, many of which simply weren’t originally conceived to be sold in such high volumes.

The latter was represented perhaps most pointedly by Ford, which propped up EV production with extraordinary measures like air-shipping parts to chase demand. The company admitted disappointment in dismal financial results, but deflected by saying that this builds market share.

Next-generation EV platforms, like BMW’s Neue Klasse models and Ford’s next-gen electric trucks, are being conceived for products to be built at an order of magnitude greater than today’s EVs. But in the meantime, more “no pain, no gain” moments may be in store for full-line automakers.