According to a recent research article by CNW Marketing Research, the 2011 Chevrolet Volt isn’t as cool as it once was.

As reported by USA Today, the research firm claims that interest in Chevrolet’s plug-in hybrid electric car is at an all-time low. CNW blames the car’s high sticker price as the main reason for a drop in interest from everyone from electric vehicle fans through to early adopters and regular car buyers.

But we’re not convinced this is the case. Here are just five reasons why we think CNW Marketing Research is wrong.

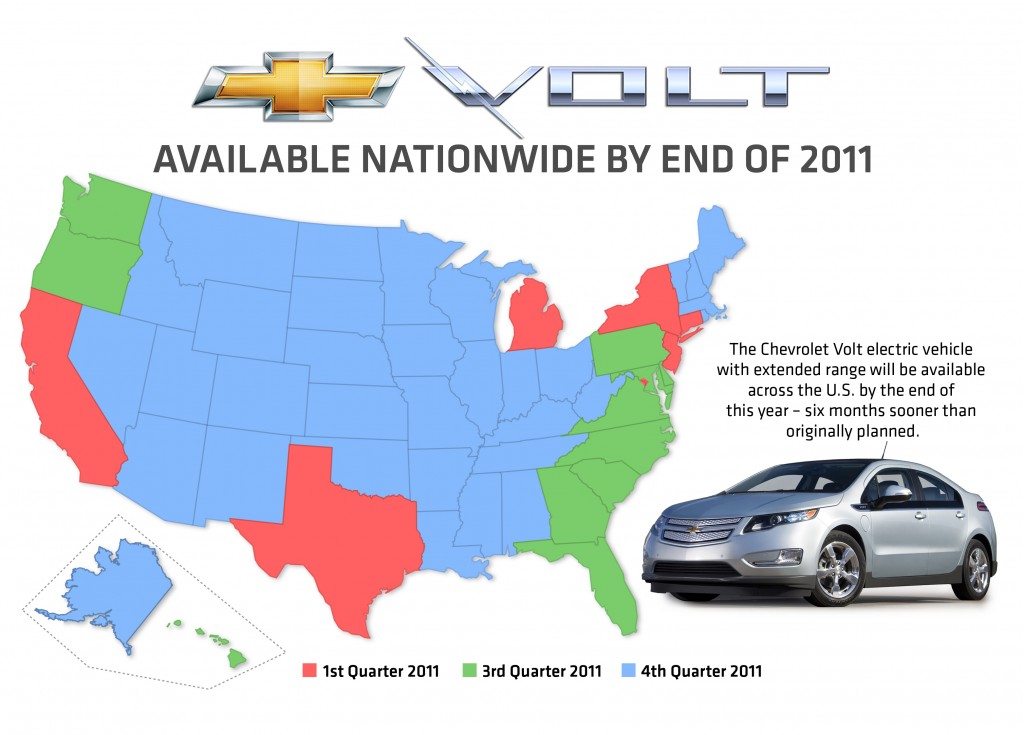

(1) The Volt isn’t sold everywhere yet

Map showing nationwide sales rollout for 2011 Chevrolet Volt range-extended electric car

First, claiming a lack of consumer interest in a vehicle which isn’t even available nationwide yet isn’t exactly fair.

That won’t happen until the end of this year, when deliveries of the 2012 Chevrolet Volt will start. For now, the Volt is only available in 19 key markets.

(2) Very few cars have been made

2011 Chevrolet Volt Production Line

Sales figures alone would suggest that the 2011 Chevrolet Volt is much less popular that the 2011 Nissan Leaf. But there’s a catch: General Motors shut down the Detroit-Hamtramck plant for a month earlier this summer, to retool it.

In other words, very few Volts were made this summer, hence very few were sold. When production of the 2012 Chevrolet Volt started last month, only 11 percent of Chevrolet Dealers had even a single Volt in stock. Only 100 cars remained unsold nationwide.

(3) Advertising is just ramping up

So far, the Volt has pretty much sold itself, with early adopters and electric-vehicle fans in key market areas accounting for much of the car’s sales.

Traditionally, buyers in this demographic require very little advertising to coax them into buying a product. They're already well aware of the car, and eager to be first.

But over the next few months, as Chevrolet becomes the first major automaker to offer a plug-in car in all 50 states, we expect a concerted nationwide advertising campaign for the Volt. That will markedly increase the awareness of--and interest in--the Chevrolet Volt.

First 2011 Chevrolet Volt delivered to retail buyer Jeffrey Kaffee, in Denville, NJ, December 2010

If there's one thing Chevy knows how to do, it's advertise its products to the broadest swath of the American public.

Have you noticed the lack of Volt ads over the last couple of months? No cars to sell means advertising stops, so awareness declines. That's about to change.

(4) Seeing is believing

The Chevrolet Volt’s consumer demographic will have to grow, to include those who make the purchase decision for pure financial reasons as well as more mainstream buyers.

Unlike early adopters and longtime electric-car fans, these buyers are likely to wait until more cars are out there, so they can see how they actually perform, rather than taking Chevy at its word.

For this group, sitting in the car and test-driving it in familiar surroundings will be paramount.

But once these buyers see Volts on the roads and understand the car's benefits, they'll come to realize that they don't have to be pioneers--that the Volt is a regular production car, with a big difference.

(5) Remember that other study?

But perhaps our biggest problem with the whole claim is not the research, but the source.

2009 Hummer H2

CNW Marketing Research is the same firm that caused a huge press furor four years ago by claiming that a Toyota Prius consumed more energy in its lifetime than a Chevrolet Tahoe sport-utility vehicle.

Right-wing media outlets jumped on its report, later debunked, to claim that the Prius did more damage to the environment than a Hummer H2.

We asked a spokesman at CNW Marketing Research about the survey, and this is what he said:

"This is part of our daily tracking of consumer sentiment. Total sample size in a year is in excess of 140,000, about 10,000 per month.

"We ask new-vehicle intenders about their future product intentions with secondary questions related to specific models.

"As for the Volt studies, each wave has included at least 8,500 respondents with an error rate of 2.7 percent. [The] sample base for Volt included one section (national) and a second section (only where Volt is sold). The data you have is only the second section and among those who are at least somewhat familiar with the Volt.

"(Naturally, the EV enthusiast category is highly familiar with the Chevy. For others, Volt is a name and product but the respondents may not be completely familiar with the nuts and bolts of the technology. They do, however, understand it is an "electric" with a gasoline-engine back up.)"

With a production of 16,000 Volts promised this year, then 60,000 Volts and Amperas for 2012, we believe a newly disciplined Chevrolet isn’t about to make vehicles it can’t sell.

What do you think? Has interest in the Chevy Volt dropped? Let us know your thoughts in the Comments below.

[CNW Research via USA Today]