Launching entirely new types of cars is expensive, time-consuming, and challenging--as Toyota could have told Chevrolet and Nissan during 2010.

Toyota's sales of its early Prius hybrid-electric cars, however, may offer hope to electric-car fans disappointed at modest sales of the two affordable electric cars sold in high volumes thus far.

In 2010, both Nissan and Chevy were preparing to launch their new plug-in electric cars.

DON'T MISS: Electric Cars Sell Faster Than Hybrids Did At Same Point (Jul 2013)

Both the battery-electric Nissan Leaf and the range-extended electric Volt were five-door compact hatchbacks, and both went on sale in December that year.

First-year sales were 7,500 to 10,000 for each, and second-year sales rose to 23,500 for the Volt while staying just below 10,000 for the Leaf.

First 2011 Nissan Leaf delivered to buyer, San Francisco, Dec 2010, photo by Eugene Lee

The third year saw sales rise to roughly 23,000 for each car. This year, we expect the Volt to stay around that number, and the Leaf to rise to perhaps 30,000.

In a market that averages about 15 million new vehicles a year--and buys 500,000 Ford F-150 full-size pickup trucks each year--those are admittedly modest numbers.

ALSO SEE: Could U.S. Hybrid Car Sales Be Peaking Already--And If So, Why?

But while the Toyota Prius may seem ubiquitous today, it wasn't always so.

In fact, Toyota sold Priuses only in Japan for three years before even putting the car on sale in the U.S. in 2000. And its sales over the first four years were equally modest.

Full-year sales of the Toyota Prius, Chevrolet Volt, and Nissan Leaf after going on sale

When you graph each of the three cars, starting with their first years on sale, you see relatively similar lines: All three cars sold 5,000 to 30,000 a year in each of their first four years.

But then the second-generation Prius launched for the 2004 model year, and its sales doubled from 24,600 to 53,991.

MORE: 2016 Chevy Volt: Bigger Battery, More Motor Power, New Range Extender Engine Details

Technically, that was the seventh year on sale for the Prius, if you count the three years of Japanese production that U.S. buyers never heard about.

We know the second-generation 2016 Chevy Volt will be introduced in January at the Detroit Auto Show, going on sale in the second half of next year.

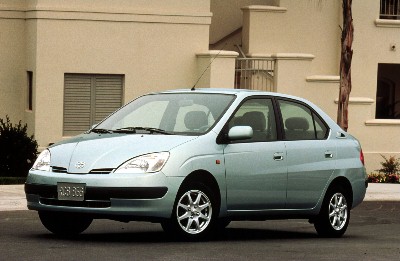

2000 Toyota Prius

And the second-generation Nissan Leaf seems likely to follow it by roughly a year, perhaps unveiled late next year or sometime in 2016, going on sale as a 2017 model.

So here's the idea: If the next Volt follows the Prius curve, its sales could double in 2016, its first full year on sale.

2016 Chevrolet Volt teaser image, with GM marketing chief Tim Mahoney, Aug 2014

Using the same percentage jump as the Prius experienced, that would take its sales in 2016--the first full year of sales for the revised model--to 50,500.

Several reasons have been suggested for the sharp rise in Prius sales in 2004:

- Gas prices rose suddenly and sharply in 2004, right as the 2004 Prius hit the market as a new model with record-breaking fuel-economy ratings

- The first-generation Prius was a subcompact, whereas the 2004 second-generation model had the interior volume of a compact car--a much higher-volume segment

- Toyota distributed the 2004 Prius nationally, rather than somewhat limiting its sales to areas known to favor small, high-mileage cars (e.g. California)

2016 Chevrolet Volt - first teaser image, Aug 2014

Several reasons also exist for not taking his comparison too literally:

- Gas prices may remain low for several years, reducing the per-mile cost advantage of the Leaf and Volt

- Chevrolet marketing may not be able to explain the Volt's range-extended electric operation any better than it's done thus far, meaning shoppers still won't understand it

- Concerns over public charging infrastructure, whether justified or not, may continue to dominate the discussion

- Prices of the next Volt and Leaf may not fall much from today's levels, which are still high enough against gasoline cars of the same size that many buyers are scared off

- The Volt will remain essentially the same size as it was before, with any fifth seat being a relatively minimal and short-term position to ride in

That said, Toyota had its own set of challenges to face in marketing and selling the hybrid-electric Prius too.

Remember the ads noting that while it was electric, you didn't have to plug it in?

RELATED: Marketing For 2016 Chevy Volt To Be Rethought, Use Owners As Evangelists

Still, the Prius curve may provide one useful model in starting to think about how sales of next-generation mass-priced electric cars may grow.

And it's worth noting that the sum total of electric-car sales in their fourth year remains far higher than the hybrid total in the same year.

There's some even better news, too.

In 2005, its sixth year on sale, Toyota Prius sales doubled once more--from 53,991 to 107,897.

[DATA SOURCES: "Hybrid Electric Vehicle Sales By Model," U.S. Department of Energy; Leaf sales from Nissan; Volt sales from Chevrolet]

_______________________________________________