It's all the buzz of the auto industry this morning: Ford has fired its CEO Mark Fields and will replace him with Jim Hackett, former CEO of Michigan furniture maker Steelcase.

Hackett presently oversees the Ford unit working on autonomous vehicles.

The company is expected to make the announcement this morning, according to numerous media reports from sources briefed on the move.

DON'T MISS: Ford plans 300-mile electric SUV, hybrid F-150 and Mustang, more U.S. production

Articles confirming the expected firing came last night from both The New York Times and business magazine Forbes.

Fields, a 28-year Ford veteran, was tapped to lead Ford in 2014 by Alan Mullaly, who had been brought in from Boeing to turn around the company in 2006.

Mullaly famously did just that, including taking a loan of tens of billions of dollars to fund a wholesale renovation of the company's global product lineup. Fields, the insider "car guy," became product chief.

Mark Fields (left) and Alan Mulally

Mullaly proved to have excellent timing, and Ford's restructuring was underway by the time of the deep recession that pushed competitors GM and Chrysler into bankruptcy.

Ford famously ended up requiring no direct financial assistance (it did receive a $5.9 billion low-interest loan from the Department of Energy), unlike the other two.

But if Mullaly's charge was to save the company, the task for Fields may have been harder still: transform it.

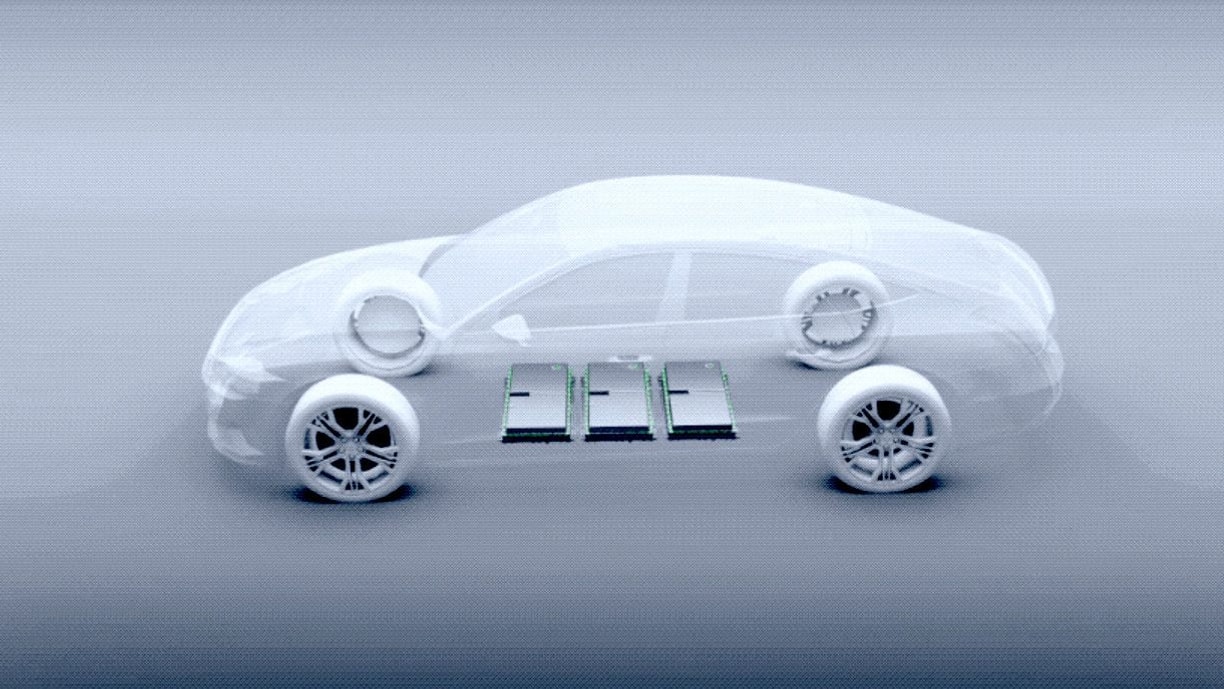

The industry widely acknowledges that the combination of vehicle electrification, autonomy, connectivity, and sharing will wreak big changes that are, so far, poorly understood.

Ford is viewed by those in the media who cover it as a company that talks a great deal about those topics, often at the expense of sharing actual information on actual cars.

2012 Ford Focus Electric

2013 Ford C-Max Energi plug-in hybrid, Marin County, CA, Nov 2012

Ford Fusion Energi charging.

But despite a flurry of press releases about projects and prototype vehicles and test cars and public demonstrations, it remained unclear how much "there" is there. Electric cars are a perfect case in point.

Ford occupies a middle ground between Fiat Chrysler—whose CEO publicly and repeatedly criticizes them as money-losers—and GM, which launched the 238-mile Chevrolet Bolt EV electric car last December.

The Dearborn maker has sold the Ford Focus Electric since December 2011, but the battery-electric conversion of the compact hatchback is strictly a compliance car to meet California rules requiring sales of a certain number of zero-emission vehicles.

CHECK OUT: Most Fords will be hybrid or electric by 2025 ... in China

More than that, Ford's dismissive attitude toward the car and the utter lack of updates until its sixth year telegraphed its disinterest in the sector.

Few makers will launch a new type of car with a strong focus on why consumers will likely not buy it.

And by 2016, the Focus Electric's EPA-rated range of 76 miles was close to the bottom of the segment, lower than all but two electric minicars: the Mitsubishi i-MiEV (62 miles) and the Smart ForTwo Electric Drive (68 miles).

Ford CEO Mark Fields at CES 2015

The company finally boosted battery capacity to give the 2017 Focus Electric a rated range of 115 miles, adding fast charging as well.

But it declined to re-engineer the placement of the onboard charger in a hump between the rear wheel wells.

That left the car's load bay deeply compromised, a problem solved by 2013 on the Nissan Leaf (which started with the same setup).

The company's actions on electric cars have followed its usual practice of issuing press releases with scant actual details about the vehicles being discussed.

In January, the company said that by 2020, it would launch an all-electric SUV with 300 miles of range, along with hybrid versions of its F-150 full-size pickup truck and its signature Mustang sport coupe.

2017 Ford F-150 Raptor

The company had previously claimed in December 2015 it would introduce 13 new "electrified" vehicles by 2020. While its press releases didn't define that term—which led to widespread misreporting that it intended 13 electric cars—for the most part it means hybrids and plug-in hybrids.

The company's most aggressive efforts on plug-in vehicles, in fact, are in China, because the government essentially mandates it.

By 2025, Ford says, 70 percent of the vehicles it sells in that country will be hybrids—either plug-in or conventional—or fully electric.

In the U.S., it continues to focus on plug-in hybrids—the Energi versions of its C-Max compact hatchback and Fusion mid-size sedan, both now in their fifth model year—which sell in far greater numbers than its sole electric car.

To be fair, Fields is hardly the sole CEO to to face the challenges of plug-in cars along with autonomy and the rest. But Ford's actions simply pale against those of competitors.

2017 Chevrolet Bolt EV electric car in Maven car-sharing fleet, Los Angeles [photo: Dan MacMedan fo

Take General Motors. It not only launched the Bolt EV, developed with Korean electronics company LG in a record three years, it bought Silicon Valley startup Cruise Automation for $1 billion.

It also took a minority share in ride-sharing company Lyft, the sole large competitor to Uber and launched a car-sharing brand called Maven.

Even Fiat Chrysler, which faces far more comprehensive structural problems, has partnered with Google's Waymo unit on self-driving vehicles and has just launched a plug-in hybrid large minivan.

The Chrysler Pacifica Hybrid has received strong reviews, and FCA is the only company in North America selling such a vehicle.

"Ford has no plausible approach towards mobility and e-vehicles yet and lags behind GM in that respect," said Christian Stadler, a professor at the UK's Warwick Business School who researches the global auto industry, "but the crucial point is that changing the CEO is not likely to change this."

"Following Alan Mulally was never going to be easy, and Fields held his own," added Rebecca Lindland, executive analyst at Kelley Blue Book, "but the reality was he couldn't rally the troops internally and pacify investors and the Ford family externally.”

Jim Hackett

With Ford's stock price down 40 percent over the course of his tenure, grumbling from Ford's network of franchised dealers, and an unclear future in a rapidly changing automotive landscape, Ford's board of directors has now concluded that Fields simply wasn't up to the job.

That indicates that Jim Hackett has his work cut out for him.

_______________________________________