Just 18 months after its $90m acquisition of Sakti3, the British consumer-products company Dyson is taking a step back.

Dyson has chosen to relinquish its rights to three patents co-owned by the company that were part of the core intellectual property of the Michigan based start-up company.

Its move demonstrates the high risk companies are willing to accept in order to be at the forefront of the next great technological advances in batteries and energy storage.

DON'T MISS: Sakti3 Claims Solid-State Battery Breakthrough For Electric Cars (Aug 2014)

EDITOR'S NOTE: After this story was published, a Dyson communications manager contacted us with the following statement, which the company requested be attributed only to "a Dyson spokesperson." We have updated the article accordingly.

Dyson is more focused than ever on energy storage solutions, which includes developing new intellectual property with the Sakti3 team. We currently own 94 Sakti3 patents and patents pending protecting those developments.

The three patents in question [on which rights were relinquished] pre-date Dyson's purchase of Satki3 and are therefore owned by the University of Michigan. The related IP has been superseded with better technology and is no longer important to our aims, so we are not renewing the license.

We remain committed to investing £1bn in battery technology over the coming years, and Sakti3 is an essential and exciting part of that program.

Ann Marie Sastry, CEO of startup lithium-ion cell maker Sakti3

This willingness of investors and the industry’s sense of urgency fell right into the lap of former engineering professor Ann Marie Sastry, founder of solid-state battery startup Sakti3.

According to Quartz, Sastry promised a revolutionary, scalable manufacturing technique for solid-state batteries, similar to that of silicon wafers.

The promise was that this would bring the price per kilowatt-hour down by five-fold compared to a similarly capable liquid lithium-ion battery cell.

Better yet, the design would be replacing the potentially hazardous liquid electrolyte with a solid wall that still had the conductivity advantages of the liquid type.

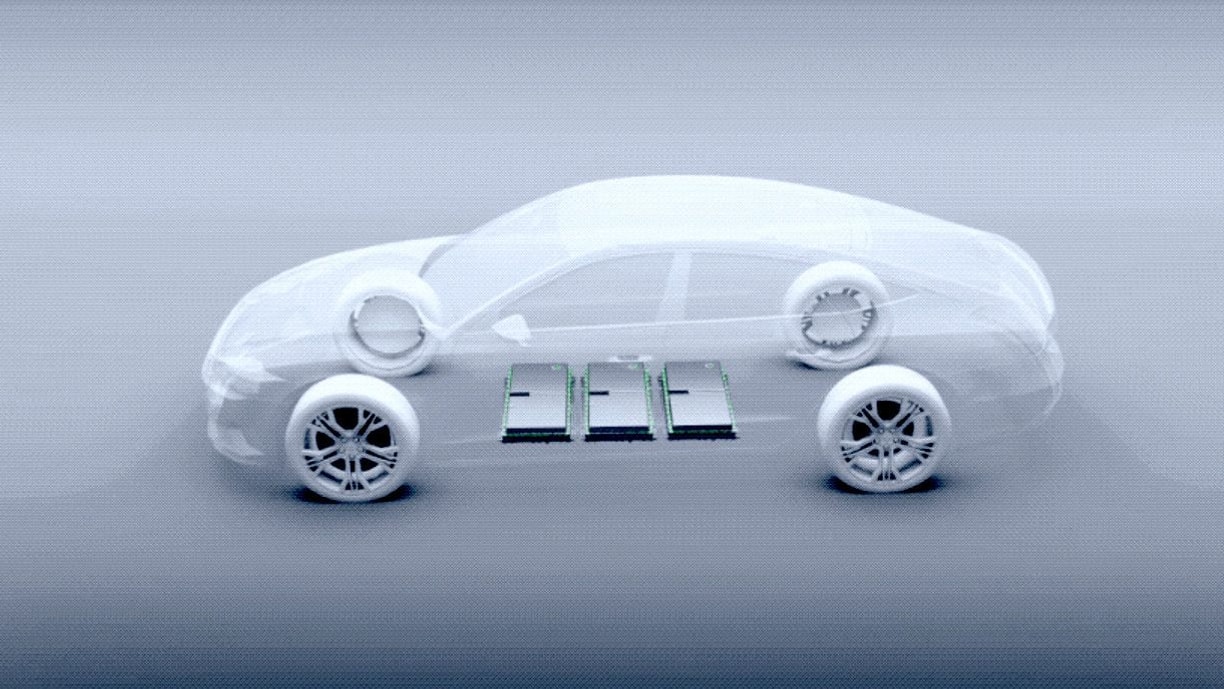

These efficiencies would make a solid-state lithium ion battery more energy-dense, which translates to weight savings.

For nearly a decade, Sastry was able to keep investor confidence high with consistently winning technology focused awards and hiring key industry specific experts.

This was all done despite never publicly releasing performance information to scientifically back up her claims.

Despite this lack of transparency, Dyson stepped forward to acquire the company in full, specifically the technology on which Sakti3’s promises were based.

READ THIS: Dyson Buys Solid-State Battery Startup Sakti3 For $90 Million (Oct 2015)

Whether the acquisition provided true technological advances or just confirmed which areas it should avoid pursuing, Dyson isn’t saying.

So it's not known exactly what knowledge Dyson gained, although its later statements indicate that Sakti3's technology had moved beyond the developments cited in the three patents it chose to relinquish.

Lower-cost and higher-density energy storage remains the subject of intense investment in research and development, not only for electric cars but also for electricity generated by peaky renewable sources.

Toyota solid-state battery prototype

This has meant that to stay at the forefront of technology development, both the automotive and utility industries must take on a certain level of risk that can involve investments in start-up companies like Maven or Zipcar.

Some automakers are allying or merging (the Renault Nissan Alliance has now added Mitsubishi as well), while others are exiting unprofitable markets and selling off operations and brands.

CHECK OUT: Tesla, SolarCity, and Ta'u: sun, storage batteries, clean energy (video)

Each major brand has their own take on priorities and how a certain technology will best be utilized.

But all are aware that the big winners are likely to be those willing to take on more risk than has been customary in the past.

—Matt Pilgrim

_______________________________________