It may not be delivering its much-anticipated 2012 Model S Sedan to the its first customer until the middle of next year, but Californian electric automaker Tesla [NASDAQ: TSLA] is now trading higher than many of its traditional gasoline rivals on the NASDAQ exchange.

At a high-point of $24.95 so far today, the electric automaker’s shares may be some way from the $35.32 high of November 2010, but hype from the recent Model S event at the NUMMI facility in Fremont, California has helped it to receive an Overweight Rating today by stock market analysts at JP Morgan Chase & Co.

What is an Overweight Rating? Simply put, it means the company stocks are expected to outperform those expected in its industry or sector, returning an above-average return compared to similar companies.

And thanks to financial uncertainty elsewhere in the world, Tesla’s shares are now worth more than shares in larger, multinational automakers like Volkswagen [NASDAQ:VLKAY}, General Motors [NASDAQ:GM], Nissan [NASDAQ:NSANY] and Ford [NASDAQ:F].

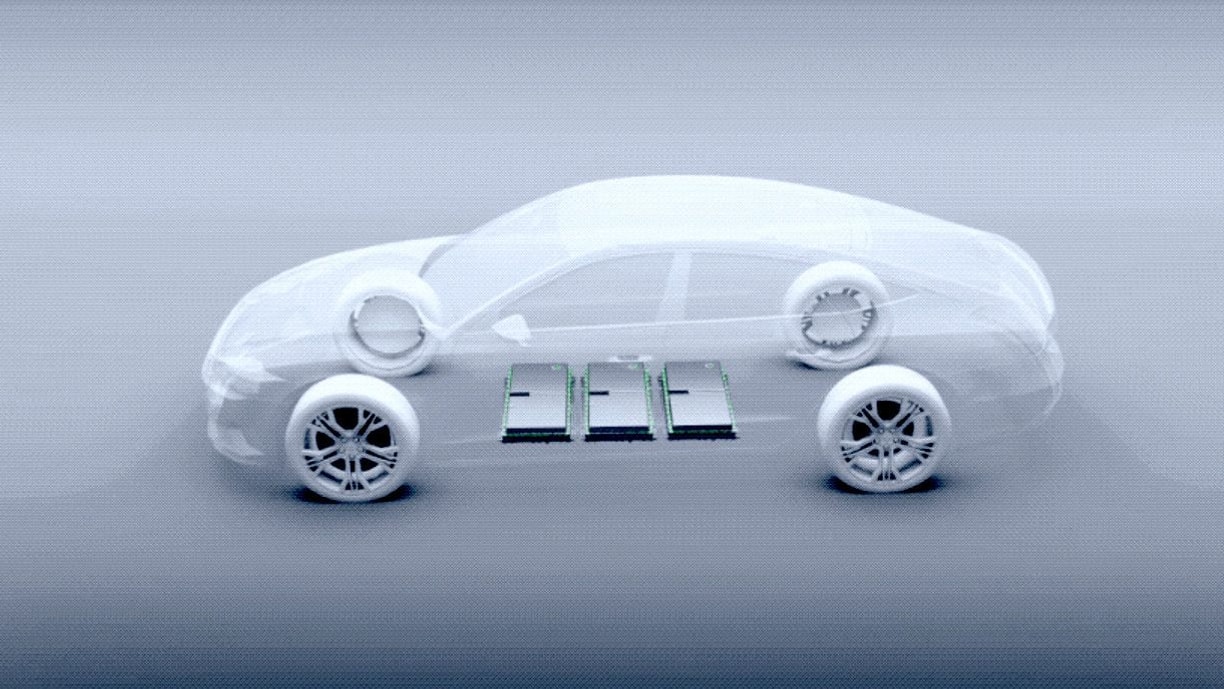

Tesla Model S Alpha build

Although Tesla still has some big challenges ahead of it, the invitation-only Model S event in Fremont over the weekend appears to have convinced buyers, and some analysts that it is capable of bringing the 2012 Model S to market.

We attended the event, and already have our first ride report written up for you to read -- as well as some new details about the car Tesla CEO Elon Musk announced on Saturday.

We’ll be bringing you more from Fremont and the 2012 Model S Launch this week, so follow GreenCarReports on Facebook and Twitter to get the very latest news on Tesla and this much-anticipated car.