Fewer Tesla EVs now qualify for the $7,500 federal EV tax credit, but for those that do, Tesla is now applying the credit at the time of purchase.

The automaker's website now says that eligible buyers will have the full $7,500 credit applied when they purchase their vehicles. Customers are responsible for determining their eligibility for the credit, which now includes adjusted gross income caps of $300,000 for married couples jointly filing taxes, $225,000 for heads of households, and $150,000 for other filers.

Tesla federal EV tax credit eligibility (Jan. 2024)

Those that receive a point-of-sale credit but exceed those income caps will have to pay the IRS back. The automaker is also limiting credits to two vehicle purchases per customer per year. Still, Tesla, with its direct-sales distribution system, may be ahead of automakers relying on franchised dealerships. Those dealerships have to individually complete a registration process with the IRS to offer tax credits at the time of purchase, and surprisingly many have either dropped the ball or decided to leave that money out of the transaction as of yet.

The federal EV tax credit became a point-of-sale rebate as of Jan. 1, which could make a big difference in EV sales. A 2022 study found that buyers would have even preferred a lower amount at point of sale versus a larger credit later.

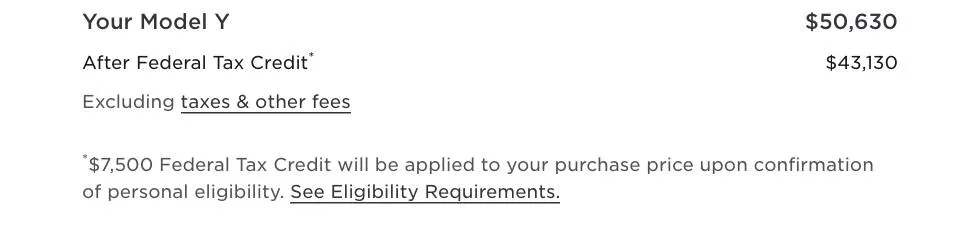

Tesla Model Y price estimate showing $7,500 tax credit (Jan. 2024)

This year also brings more restrictions on battery materials sourcing, meaning fewer EVs qualify for the credit now. Tesla started warning customers in Dec. 2023 that the Model Y "likely" wouldn't retain the full tax credit for 2024, although it does appear to still qualify in at least some configurations.

Price caps of $55,000 for cars and $80,000 for SUVs and pickup trucks apply too. That doesn't appear to have incentivized either Tesla or other EV makers to provide more affordable models quite yet.