U.S. EV sales are growing, but not enough to offset gasoline cars. That's because sales of those vehicles are growing faster, according to a new report.

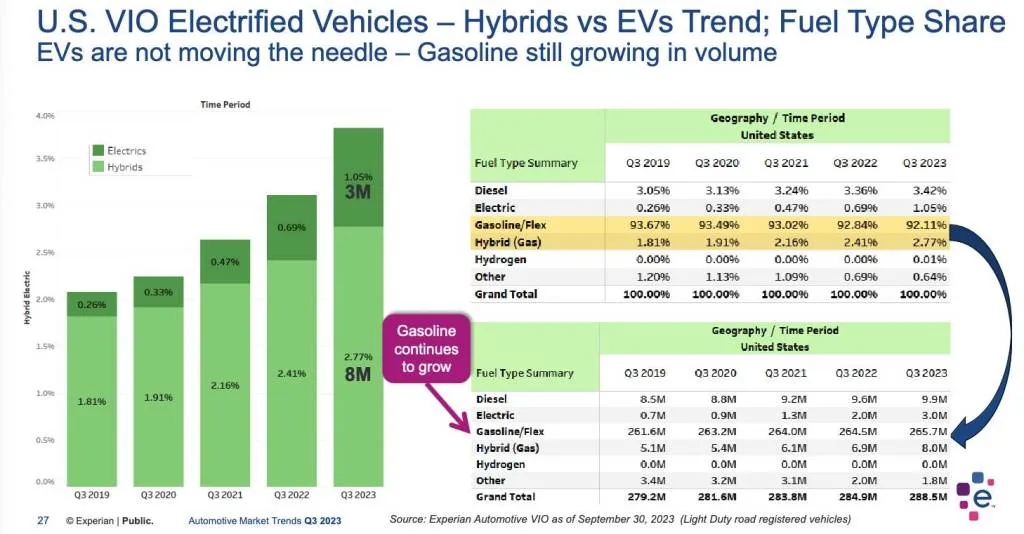

Experian's Automotive Market Trends report for the third quarter of 2023 showed that while electric cars now account for a larger share of the U.S. vehicle fleet than they did a few years ago, the size of that fleet has grown overall—with gasoline cars accounting for most of that growth.

Despite EVs growing from a quarter of a percent of the U.S. fleet in 2019 up to more than 1% of the fleet today, that hasn't been enough to offset the growth of gasoline models—because it only amounts to about 2.3 million additional EVs nationally over those four years, while the gasoline fleet has increased by more than that (even not including hybrids).

U.S. vehicle market share by propulsion type (via Experian)

During this time, the U.S. vehicle fleet grew from 279.2 million to 288.5 million vehicles, according to Experian, but the number of EVs included within that only grew from 0.7 million to 3.0 million.

And as a report from the International Energy Agency (IEA) Thursday underscored, oil demand into next year remains strong. That said, EVs and hybrids are on a steady trajectory to eventually offset gasoline models—in another year or two, perhaps.

EV sales are expected to make up about two-thirds of global car sales by 2030. And globally, internal-combustion vehicle sales peaked a few years ago according to Bloomberg.

2022 Porsche Taycan GTS Sport Turismo

In the U.S., EV interest has stayed strong, but it's lopsided. EVs are more than a third of the luxury vehicle market while less than 2% of the non-luxury market. As J.D. Power recently argued, there's a vast "missing mass market" for EVs—not due to a lack of demand but due to a lack of product.

Experian is reporting the trends, not forecasting, so it declined comment regarding when it expects the fleet of gasoline vehicles to actually be in decline in the U.S. But considering the average age of the vehicle fleet currently 12 to 13 years, it might be several years.

When it comes to reducing emissions, regulators may be too focused on EV sales and not focused enough on retiring internal-combustion vehicles.