It's been a very, very tough 18 months for lithium-ion cell maker A123 Systems.

In late May, the company said there was "substantial doubt" about its ability to remain in business.

Now, A123 has announced a tentative deal to recapitalize the company that would--if approved--give an 80-percent ownership stake to China's largest auto parts company, Wanxiang Group Corp.

Wanxiang would invest up to $450 million in A123, though the deal will have to be approved by both the U.S. and Chinese governments. A123 said it hopes to close the deal by the end of this year.

Meanwhile, A123 is receiving a bridge loan of up to $75 million from Wanxiang, at a stiff 10-percent interest rate.

Getting approval for the deal could be challenging. A123 has received both a $249 million stimulus-program grant from the U.S. Department of Energy and $238 million from the state of Michigan.

Given the focus during the presidential election season on DoE grants and low-interest loans to green energy companies, the A123 investment may come at an awkward time.

The Obama administration could be faced with a challenge: Should it approve funding to keep a U.S. company in operation even if it ends up owned by a Chinese company? Or should it cut its losses?

A123 Systems [NSDQ:AONE] is based in Waltham, Massachusetts, but it now has about 800 employees in two Michigan plants, in Livonia and Romulus.

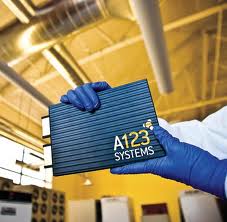

![A123 Systems Employees Perform Quality Check on a Lithium-Ion Battery Pack [source: A123 Systems] A123 Systems Employees Perform Quality Check on a Lithium-Ion Battery Pack [source: A123 Systems]](https://images.hgmsites.net/med/a123-systems-employees-perform-quality-check-on-a-lithium-ion-battery-pack-source-a123-systems_100393556_m.jpg)

A123 Systems Employees Perform Quality Check on a Lithium-Ion Battery Pack [source: A123 Systems]

A123's troubles began last year, when Fisker--its largest automotive customer--cuts its orders for A123 cells due to substantial delays in launching its Karma range-extended electric luxury sedan.

The company had to lay off some employees as a result.

Then, in March, A123 was forced to recall lithium-ion cells made in the Livonia plant due to a manufacturing flaw. That meant it had to cover the costs of a new battery pack for every 2012 Karma built to that point--several hundred cars at least.

The coup de grace may have come in April, when A123 cells were deemed the cause of an explosion at GM's main battery laboratory in Warren, Michigan, that injured one person and closed the entire lab building.

A123 Systems Prismatic Cell

Despite some good news--the DoE lengthened the time in which A123 could use its grant funds, and the company announced a new, more durable cell chemistry--analysts say the writing was on the wall for some time.

A123 supplies lithium-ion cells for hybrid and electric vehicle batteries to several manufacturers, including Fisker Automotive--for its Karma range-extended electric luxury sedan--and BMW for its ActiveHybrid line of 3-Series, 5-Series, and 7-Series sedans.

Its cells will also be used in the limited-production Chevrolet Spark EV, which will be sold in small numbers as a compliance car to meet California zero-emission vehicle mandates.

+++++++++++