We've written before about the growing shortfall in gasoline tax revenues versus the highway and bridge repairs those taxes are supposed to fund.

The Federal Highway Trust Fund now has an estimated backlog of $400 billion in repairs between now and 2015 just to bring the complete national highway system to a state of good repair.

And the number gets worse every year, as tougher fuel economy standards--34.1 mpg by 2016 and no less than 54.5 mpg by 2025--will further reduce gas tax revenues across the board.

State taxes troubled too

Now the Institute on Taxation and Economic Policy has issued a report highlighting the dire state of the other portion of the taxes wrapped into what you pay at the pump: the gasoline tax collected by the individual state.

The new report, Building A Better Gas Tax: How To Fix One Of State Government's Least Sustainable Revenue Sources, notes that the gas-tax rate has stayed constant for more than 10 years in the "average state," and 14 states haven't raised their gasoline tax in 20 years or more.

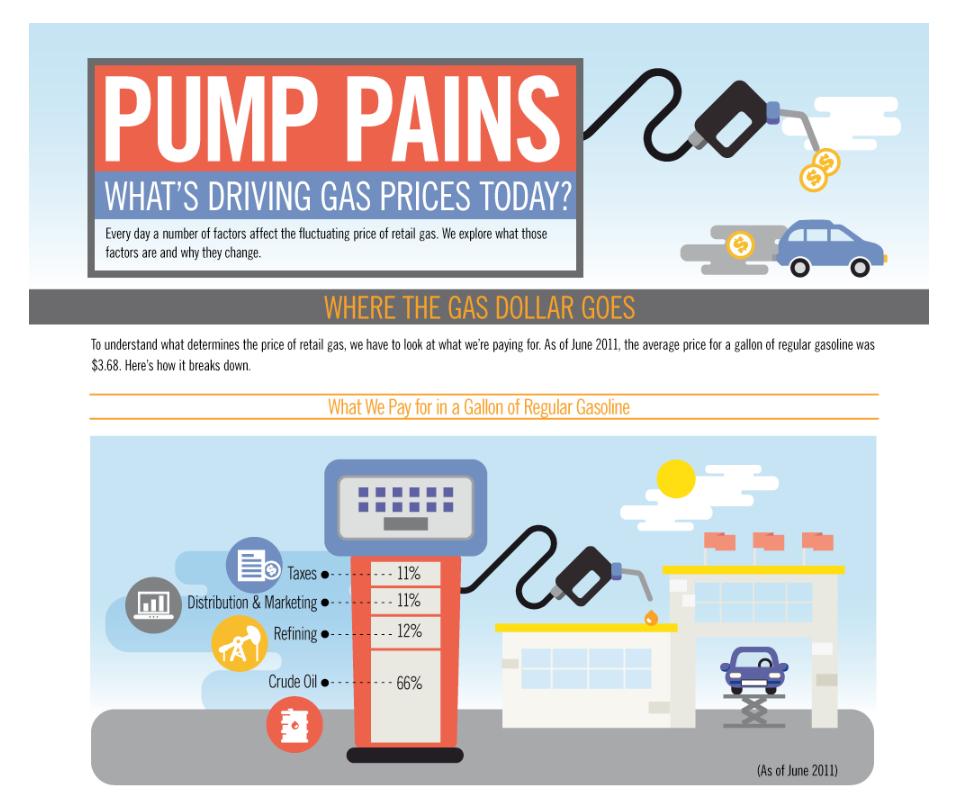

Infographic: 'What's Driving Gas Prices' from One Block Off the Grid

The report concludes that for the average state, the value of the gasoline tax has fallen 6.8 cents, or 20 percent, since it was last raised. If every state raised its gasoline tax merely to offset recent growth in transportation costs, more than $10 billion in additional funding could flow to road repair.

Hybrids pay less, electrics don't pay at all

In the state of Washington, for example, hybrids like the Toyota Prius use less fuel and pay less tax. And electric cars like the Nissan Leaf that recharge from the electricity grid pay no gasoline tax whatsoever.

The shortfalls are substantial. If Virginia's gas tax had stayed constant with construction costs, it would have taken in $578 million more; Maryland, $509 million; New Jersey, $505 million; Massachusetts, $451 million; and Oklahoma, $338 million. The list goes on, state by state.

Recommendation: raise rates

The Institute offers three recommendations: Raise state gas-tax rates to make up for lost revenue, index them to keep pace with construction-cost inflation in the future, and create or enhance tax credits for low-income families to offset the impacts of the increases.

Gas pump

Rather than raising gas taxes, which can turn into a political flashpoint, states are "raising sales taxes, fees on vehicles, tolls on roads, even looting education funds," says Carl Davis, a senior analyst at the institute and the author of the study.

Still, "many politicians won't consider touching the gas tax," David says. "It makes no sense."

There are two main problems with the institute's proposal.

All taxes bad, all the time, always

First, the mantra propounded by portions of the political spectrum that "any new or increased tax, of any kind, for any purpose, under any circumstances, is unacceptable" has become so embedded that it may be well nigh impossible to increase gasoline taxes at the state or Federal level.

41Cent Gas Pump

Secondly, even if the rates were raised, some states have historically raided transportation funds to make up for shortfalls in general revenue. Without "lockbox" legislation that legally sequesters gasoline taxes either to road repairs and construction or to general transportation purposes, motorists might pay more without a dime of it going toward roads.

What should we do?

So if the Feds can't raise the Federal gas tax, and states can't raise the state portion of the gas tax, how DO we pay for the rising backlog of road repair? Or do we let roads and bridges continue to decay, slowly but surely?

Leave us your thoughts in the Comments below.

+++++++++++