That sound you heard yesterday was the other shoe dropping.

The U.S. Department of Energy is offering its loan to Fisker Automotive for sale to the highest bidder, with a remaining face value of $164 million.

The DoE did the same a few weeks ago with a much smaller loan--$45 million--to Vehicle Production Group, bought by AM General.

Fisker Atlantic concept unveiling before New York Auto Show, April 2012

Fisker was approved for a total loan of $528 million in November 2009, but the DoE froze disbursements in June 2011 when the company missed numerous deadlines.

At that point, $192 million had been loaned to Fisker; the department later recouped $28 million from Fisker accounts.

In a post on the DoE blog late yesterday afternoon, Peter W. Davidson, executive director of the department's loan program office, wrote:

Unfortunately, as has been widely reported, Fisker Automotive has experienced major setbacks in their production schedules and delayed sales that caused them to miss critical milestones laid out in their loan agreement with the Energy Department.

After exhausting any realistic possibility for a sale that might have protected our entire investment, the Department announced today that we are auctioning the remainder of Fisker’s loan obligation, offering the best possible recovery for the taxpayer.

Consistent with the intent and statutory purpose of the Advanced Technology Vehicles Manufacturing program, the Department will require all bids to include a commitment and business plan that promotes domestic manufacturing capabilities and related engineering for advanced technology vehicles here in the United States.

2012 Fisker Karma during road test, Los Angeles, Feb 2012

Reiterating a talking point much used by the DoE against criticism of the losses on a few ATVM loans, Davidson noted that the projected losses only represented about 2 percent of the overall $34 billion portfolio, and less than 10 percent of the loan-loss reserve allocated by Congress.

Ford and Nissan were by far the largest loan recipients under the ATVM, at $5.9 billion and $1.6 billion respectively.

Tesla Motors, which received $465 million, paid back its entire loan this past spring.

What's it worth?

The major question, of course, is what the remains of Fisker Automotive may be worth--and who will bid on the loan.

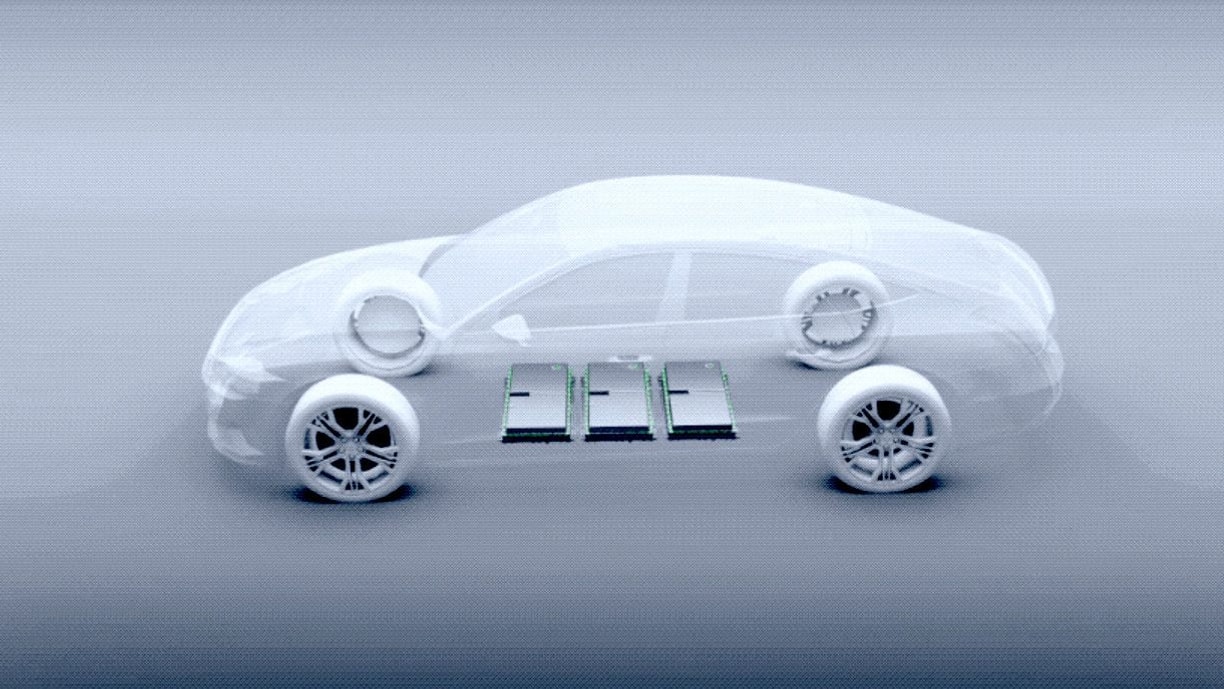

The company stopped production of its Karma range-extended electric luxury sedan in July 2012, after building 2,000 or more. Development of its next vehicle, the less expensive mid-size Atlantic sedan, has halted.

Green Car Reports broke the news last week that the Fritz Nol partnership had submitted a signed offer for what's left of Fisker to the DoE.

Henrik Fisker

Last month, the German AutoBild reported that their bid was an offer of just $25 million., but that price hasn't been confirmed.

Original cofounder Henrik Fisker--who left the company in March--has discussed making an offer, with funding from an investor group in Hong Kong.

Former GM product czar Bob Lutz put in a bid back in May; his VL Automotive concern previewed a V-8-powered Karma called the Destino.

But if you're thinking of putting in a bid yourself--the DoE description is online, with initial bids due October 7--be aware that the two largest Kickstarter campaigns so far have raised only $8.6 million and $10.2 million respectively.

What's Fisker worth, and what are the opportunities and challenges facing the successful bidder for the DoE's loan?

Leave us your thoughts in the Comments below.

_______________________________________________