Well, looks like Chrysler is getting closer to playing with the big kids at last.

The back-from-bankruptcy third U.S. automaker, now effectively controlled by Italy's Fiat, is putting together a financial package that will allow it to pay off all the money invested in it by the Obama Administration during the 2009 auto-industry bailout.

Once it's paid the U.S. government with money raised by selling bonds and taking out private loans, the application it submitted last year for low-interest loans from the U.S. Department of Energy can be considered.

2012 Chrysler 300 SRT8

Today, Energy Secretary Steven Chu told Reuters the Obama Administration is "hopeful" Chrysler would qualify for the loans, though it would be premature for him to comment on Chrysler's chances of approval.

As tea leaves go, that would suggest Chrysler has a pretty good shot at getting its cash.

Necessary capital

Those loans, part of the $25 billion Advanced Technology Manufacturing program, can only be granted to companies that are viable businesses even without receiving the loans.

As long as it was being funded by the U.S. government, the DoE wouldn't loan Chrysler the money. Its current applications request roughly $3.5 billion in low-interest loans.

CEO Sergio Marchionne is counting on that cash nonetheless, which will let Chrysler refurbish factories to build far more fuel-efficient and competitive cars.

Roughly 70 percent of the company's sales today are deemed light trucks: pickup trucks, minivans, and crossovers.

GM misses out, pulls out

While Ford, Nissan, and Tesla were approved for their loans in June 2009, joined that September by Fisker Automotive, General Motors was precluded from DoE approval due to its own bankruptcy.

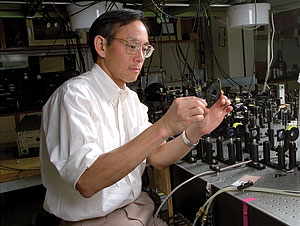

Dr. Steven Chu, U.S. Secretary of Energy

This past January, however, GM withdrew its application to the DoE for $14.4 billion of loans.

“Withdrawing our DOE loan application is consistent with our goal to carry minimal debt on our balance sheet," said its then-CFO, Chris Liddell.

Analysts surmised at the time that GM wanted to minimize the opportunity for critics to continue to tar it as "Government Motors," since the U.S. may still lose as much as $10 billion on the GM bailout.

Chrysler, assuming it pays back its loans in full, has no such worry.

Not always "yes"

The DoE low-interest loans require the money to be invested in advanced technology for vehicles that provide significantly greater fuel efficiency than existing models.

No greenfield sites are eligible; the plants to be renovated must be at least 20 years old.

The DoE doesn't always say yes to loan applicants, however. In March 2010, it turned down a $321.1 million loan application by the secretive V-Vehicle Corporation (VVC), which hoped to retrofit a former headlight plant in Monroe, Louisiana, and hire 1,400 workers to build a low-cost, composite-bodied car.

[Reuters]

+++++++++++