A new survey of Northeastern drivers suggests the demographics of future electric-car buyers in that region may evolve from the Baby Boomers who’ve bought most of them so far to Millennial buyers who see them as an inevitable part of a tech-focused lifestyle.

Released Thursday at the New York Auto Show, the survey showed that at least some portion of all demographics believe electric cars will become a more important segment of the U.S. car fleet. Beyond that, however, differences in acceptance, attitudes, and worries emerge:

- Awareness is high: Roughly half the respondents (51 percent) are somewhat or very likely to consider an electric car when shopping for a new vehicle. Today, just 3 percent of Northeasterners own a vehicle that plugs in.

- Age matters: Among Millennials (born 1981-1996), 63 percent are likely to consider an electric car, but for Baby Boomers (born 1946-64), it’s just 38 percent.

- Charging stations are a huge concern: All groups surveyed agreed there aren’t enough public charging stations available.

- More charging stations could boost purchases: Fully 80 percent of Northeasterners said they would be “more likely” to consider buying an EV if there were more charging stations in their area.

- Awareness of charging stations is growing: Almost half of respondents had noticed more electric-car charging stations in their area.

Positive indicators electric cars are here to stay - ZEV Mediagenic Online Survey, March 2019

Together with California and Oregon, Northeastern states have pledged to add millions of plug-in cars to their roads by 2025, according to an eight-state pact signed in 2014. It’s all in the name of reducing greenhouse-gas emissions, but the Northeast’s share to date of those 3.3 million battery-electric and plug-in hybrid vehicles has lagged severely.

MORE: Genesis Mint Concept: luxury urban electric two-seater debuts in New York

With just six years left to reach the plug-in goal, 16 carmakers have allied with seven Northeast states to encourage electric-car purchases via a campaign called “Drive Change, Drive Electric.” Now in its second year, the group spent much of the past year surveying the attitudes of drivers in the region.

Among other results, the survey also found the following:

Charging station availability is primary concern - ZEV Mediagenic Online Survey, March 2019

- Financial incentives matter: For all ages surveyed, the availability of tax credits or rebates was a key purchase motivator—either first or second in importance.

- Electric cars are the future: All groups agreed that electric cars are “the wave of the future,” though again, Millennials were more enthusiastic than Baby Boomers.

- Range remains a concern: Along with availability of charging stations and high upfront cost, the range of EVs is a top concern for potential buyers. (Many are likely not aware that several vehicles rated at more than 200 miles are now offered at less than $40,000.)

- Gender gap is low: Both men and women in the Northeast do not feel knowledgeable about electric cars, though the rate is slightly lower for men (53 percent) than it is for women (64 percent).

The 10-minute online survey conducted in March covered licensed drivers 16 and older in seven Northeast states. The pool of respondents was adjusted to be proportional to each state’s population.

Incentives a primary motivator for electric-car purchase - ZEV Mediagenic Online Survey, March 2019

Online surveys such as this one can lack nuance and the ability to dig more deeply into the findings. One question the survey didn’t ask might have addressed the level of awareness among respondents that the vast bulk of electric-car charging happens at home, overnight, or during the daytime at work.

Another might have been the degree to which respondents felt they knew how to locate public charging stations, whether through mapping software, dedicated apps, or other methods.

Talk to California?

Still, many of these concerns have been broadly known for years—especially in California, where roughly half of all cars with plugs have been sold to date in the U.S.

In an interview, we asked Julia Rege, senior director for environment and energy at the Association of Global Automakers, whether the group had spoken to its California counterparts on lessons learned and best practices for approaching consumers.

MORE: Tesla launches battery recycling at Nevada Gigafactory

“We weren’t completely surprised,” she acknowledged, at some of the broad themes, issues, and impediments that emerged. But, she said, the age differences in attitudes were a surprise, indicating that the early-adopter profile—older, wealthier, largely male—won’t necessarily fit the EV drivers of the future.

Driving range of electric cars a perceived drawback - ZEV Mediagenic Online Survey, March 2019

Rege also noted that data specific to Northeastern drivers didn’t exist, which led the group to conduct its survey—so recommendations could be regionally tailored if necessary.

Electric cars = iPhones

Another finding, not covered in the presentation but discussed during our interview, indicated that a broad array of younger drivers are driven by technology. While the affluent Boomers who bought electric cars to date included lots of tech early adopters, the central role of smartphones in younger drivers’ lives makes tech increasingly important to their everyday lives.

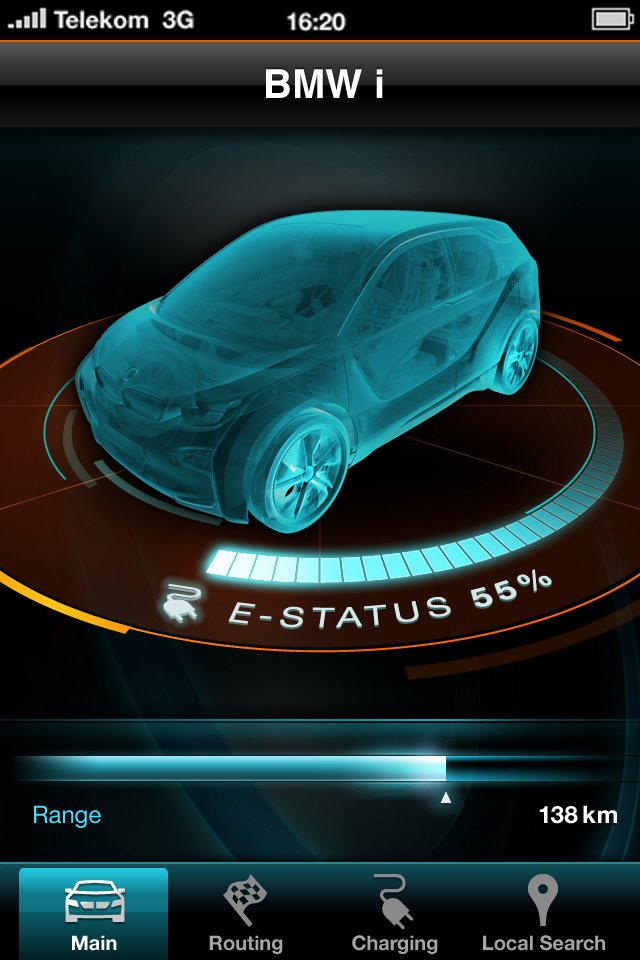

2013 BMW i3 Electric Car Smartphone App

Electric cars, Rege suggested, are viewed as new and more advanced technology. This could mean marketing campaigns that don’t necessarily talk about carbon reduction or the performance of the cars, but tie them to a tech-centric lifestyle.

We’d add that smartphone apps for most electric cars now provide remote climate conditioning when plugged in, regulate charging time, and offer data on the car’s battery state at any time—all demonstrations of advanced technology not offered today on most cars with combustion engines.

What’s next?

With survey data in hand, the group hinted, a marketing effort appears likely to launch fairly soon. Our interviewees were circumspect, but suggested that such a campaign might center around a softer presentation of “the EV lifestyle” to underscore the idea that charging stations already exist.

Along with the performance attributes of electric cars—acceleration!—such a campaign might highlight the fun factor of driving them. “Don’t tell me what to do, show me my options,” was the Millennial attitude summarized by Sarah McKearnan, senior policy advisor for NESCAUM, the Northeast States for Coordinated Air Use Management.

Stay tuned on that front, clearly.

The seven states taking part in the “Drive Change, Drive Electric” campaign are Connecticut, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, and Vermont. The automakers are BMW, Fiat Chrysler, Ford, GM, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Toyota, Volkswagen Group, and Volvo. Many are members of the Association of Global Automakers, a trade and lobbying group based in Washington, D.C.