It's baaaaaaaaaaaack.

U.S. Department of Energy Secretary Ernest Moniz announced yesterday that the DoE had revised and updated its Advanced-Technology Vehicle Manufacturing (ATVM) program, which offers low-interest loans to carmakers and their suppliers.

Any new loans, according to a Detroit News interview with Peter W. Davidson, executive director of the Energy Department’s Loan Programs Office, will most likely go to auto-parts makers, not car companies themselves.

2012 Tesla Model S beta vehicle, Fremont, CA, October 2011

“The goal is to help finance projects that will improve fuel efficiency," Davidson told the News, saying some parts suppliers need access to capital as the auto industry recovers--but that he didn't expect major automakers to apply.

As well as more fuel-efficient gasoline and diesel engines, the program is open to funding technologies for plug-in electric and natural-gas vehicles.

And the DoE is open to extending loans to suppliers outside North America that may be interested in moving production to the U.S.

Ford, Nissan, Tesla...and Fisker

In its first iteration, the ATVM program authorized loans to Ford, Nissan, and Tesla Motors back in June 2009, and then one to Fisker Automotive that same November.

Ford's 1.0-Liter EcoBoost Engine

In total, the department issued almost $9 billion in loans to makers of both cars and components, all of them to speed production of vehicles that achieve at least 25 percent better energy efficiency than the ones they replace.

But the program has been periodically attacked by members of Congress since then, including efforts by some to shut it down altogether.

$139 million loss on Fisker

The ATVM's nadir may have come after the DoE froze disbursements to Fisker in early 2011 for missing numerous deadlines and milestones, after it had disbursed $192 million of Fisker's authorized $529 million in funds.

Fisker stopped making cars in July 2012, and finally declared bankruptcy last fall. The DoE lost $139 million on that loan.

While Fisker's assets were ultimately sold in February to Chinese parts maker Wanxiang for $149 million, the DoE received only $25 million from that process.

Ford and Nissan, on the other hand, which received $5.9 billion and $1.6 billion respectively, are now paying down their loans on schedule. Tesla, which received $465 million, paid its loan in full last May, several years early.

The ATVM program was created by Congress in 2007 with $25 billion in lending authority, meaning it has $16 billion remaining.

Department of Energy crest

Many technologies, more responsiveness

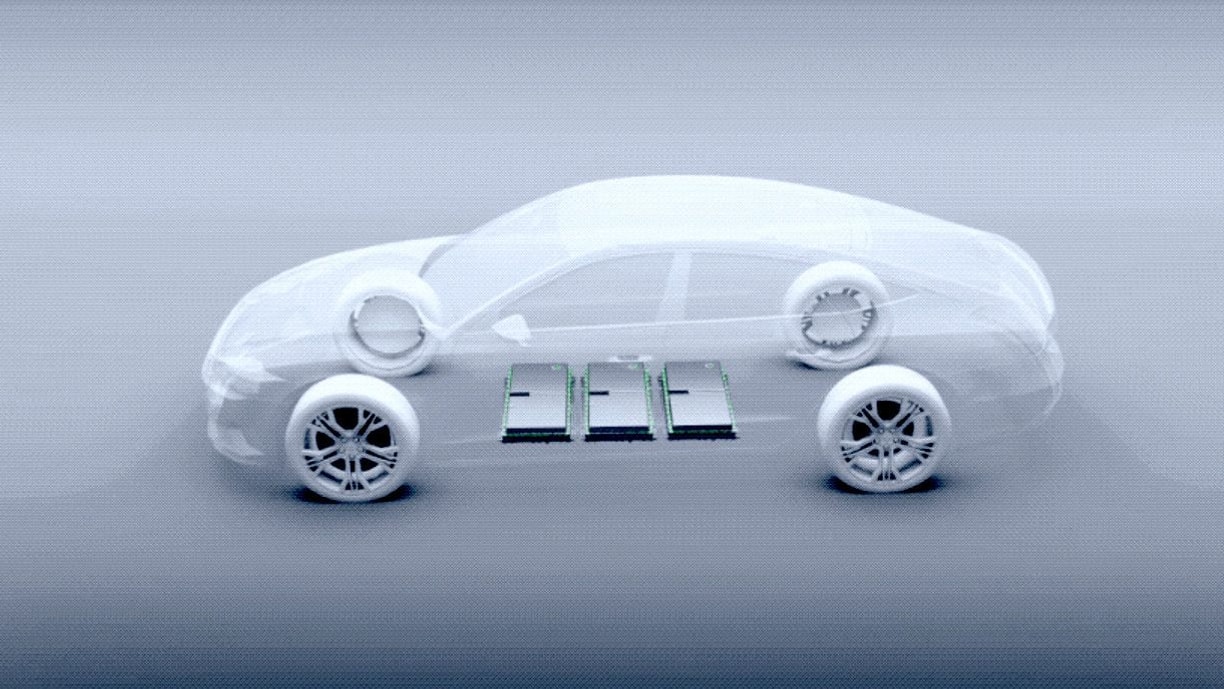

Yesterday's changes clarified that a "broad range of automotive component technologies" qualify for loans under the program, including "advanced engines and powertrains, light-weighting materials, advanced electronics, and fuel-efficient tires."

The department also attempted to make the process of applying for loans more transparent, and pledged to be more responsive to applicants during that process--addressing a frequent criticism of companies denied loans from 2009 through 2012, who said they simply heard nothing from the agency.

Finally, the DoE said, it has revised the application process itself, and put more of that process online.

Desired effects

The Energy Department credited its earlier loans to carmakers with helping the industry to update plants and launch more efficient vehicles, as it was designed to do.

Its earlier loans, it said, had allowed "Ford to modernize 13 facilities in 6 states for the manufacture of fuel-efficient vehicles and components, including the Ecoboost engine; Nissan to construct the new Leaf battery facility, Leaf vehicle assembly line, and electric motor manufacturing facility in Tennessee; and Tesla to open and modernize a shuttered California auto plant to become Tesla’s assembly facility for all-electric models."

If new loans go largely to firms that supply parts and components to automakers, however, the names are less likely to be familiar to the public.

That may let the program fly somewhat more under the radar than it did with the high-profile loans of 2009.

_______________________________________________